Sign up for Relayer Report here

It’s been a busy couple weeks at the 0x office, with updates on all fronts. We’ll be hosting some events at ETHSF, and really want to encourage as much hacking on our protocol as possible. For hackathon ideas read this blogpost here, and also check out this general event guide from CryptoWeekly.

Starting next newsletter we’ll be adding the Everbloom team to the Relayer Report, who are a dEX incorporating 0x V2 that wants to get a broker/dealer license. More info here, very cool to see relayers targeting new and unexplored verticals.

The Future of Gaming

As I mentioned in RR #10, 0x V2 has officially launched, with mainnet testing now complete. The key words for V2 are modularity and extensibility, which will allow devs to be creative with what they can build on 0x. NFT support has been a big part of V2, and we’re already seeing traction. Gods Unchained, an Ethereum based trading card game that recently sold 1 million cards, is building its player marketplace on V2, meaning when players trade their NFT-based cards they do it directly with each other as opposed to having a centralized intermediary in between. Check out an interview with Gods Unchained co-founder James Ferguson below.

This is a small glimpse into the power of a protocol for decentralized exchange. Anything that was peer to peer in the real world is now getting a digital, blockchain based facelift, which VentureBeat reported on as well. I used to play Yu-Gi-Oh! a lot when I was a kid, and when I was helping my parents move houses, I found a huge box of cards that I had completely forgotten about. I thought to myself these cards would probably be valuable to someone, somewhere, but I hadn’t played in years and I didn’t know anyone who still did. Going to eBay, finding which cards were valuable, posting a hundred sell orders and shipping each card around the world sounded like a nightmare to me. So all my Yu-Gi-Oh! cards are still in the box, rotting away.

Now imagine instead I found on my private wallet a huge stack of Gods Unchained cards. I could immediately find out the going rates for all my cards, check the source code to see how many copies were ever made, and sell them across the world almost instantly. I would have complete ownership of a digital asset with computational proof of what it actually is and how many duplicates exist. I could even bring these collectibles with me to Gods Unchained 2 as a vintage legacy item, with the portability of these NFT assets letting game developers build networks and lineages into game play. And the best part is my holographic limited edition Blue Eyes White Dragon could never have coffee spilled on it (though I guess I could lose my private key… we need more user friendly wallet tech!). A very small use case, maybe, but then let’s take it a step further: in his talk at ETHBerlin, Nadav from Dharma mentions that Dharma would soon like to offer NFT-collateral based loans. So I could take my ultra-rare Gods Unchained card, use it as collateral for a cryptocurrency loan, and then use that money however I see fit. This is so freaking cool. This is the open Internet I was promised. (That being said, NFT collaterals sound great in theory but it sounds like a nightmare trying to analyze the risk profile of a Crypto Kitty. But maybe there would be a Dharma underwriter and relayer that focused on giving NFT based loans.)

Utility for the user is one angle to look at the blockchain and video game connection, but another is video games as a vehicle for mass blockchain adoption.

Loom Network had a great article on this titled, “Games Will Be the Catalyst for Blockchain Mass Adoption.” Here, Loom articulates its vision that a blockchain based game will be the first killer app of the Ethereum ecosystem, something I agree with. The explosion of PokemonGo and Fortnite are prime case studies in how fast video games can reach millions of users. With Epic Games’ partnership with MagnaChain (a blockchain built specifically for gaming), Fortnite on the blockchain might not be so far away. The asterik here of course is that the mainstream video game industry has shown absolutely no signs of slowing down, so competing against these giants with blockchain based games (like Loom Network might want to do) will be difficult.

The final interesting piece in all this is that gamer and crypto values are pretty aligned. The best example of this of course is Vitalik Buterin himself:

“In a life defining moment, Buterin remembers playing World of Warcraft in the year 2010. One day, Blizzard made the decision to remove the damage component of ‘… [his] beloved warlock’s Siphon Life spell.’ Crushed, he ‘cried [himself] to sleep,’ and ‘realized what horrors centralized services can bring’” (Blockonomi).

Think of mods, which are fan alterations to video games, and how similar that sounds to an open source fork. So here we have a huge industry with cryptocurrency like values and an insanely fast ability to evangelize new technology. This sounds like a recipe for disruption… and to any Dune fans sounds like Paul Atreides finding his army in the Fremen. If you can’t get enough of the latest in NFTs, Tom of 0x will be speaking at the NonFungible Summit on October 12th in San Francisco.

P.S. I also heard about a company named Blok.Party for the first time, which raised $10 million and is adapting Settlers of Catan to its blockchain game console. (More info here). 10 million is a lot of money, what is a blockchain game console, and then this quote:

“Most of the pieces are digitized too, and we used and traded our cards using smartphones. But there is a physical ‘robber’ piece, because Chen said this allows the robber’s movement to remain ‘a very visceral experience … that a digital version can’t ever capture.’”

I think I just have to be a VC here and ask what my six year old daughter thinks about this trend. If you’re interested also check out their promo videoand tell me if you would play this thing.

Clash of the Titans

At first, there seemed to be enough of a market for Coinbase and Binance to do their own separate thing. Binance with a regulation later, global, speed-first approach, Coinbase with the law-abiding, secure, US-centric approach. But now these companies are too big, and the curse of ever-increasing ambitions and growth has set these them on a collision course.

There was a profile on Coinbase by Fortune titled, “Coinbase Wants To Be Too Big To Fail.” The article has some interesting tidbits, like that Coinbase is making a big push into security tokens, as well as some amazingly ridiculous lines:

“Fretting about compliance didn’t endear Armstrong to the crypto world’s self-styled renegades, whose tastes run towards cocaine, Lamborghinis and anti-government diatribes.”

“He and a small retinue are gathered in a hotel restaurant near Dupont Circle, where the food is both expensive and mediocre.”

And some great ones:

“Armstrong, for his part, is showing his staff that he too can chill out. This includes recapturing some of the vibe from the company’s early days. Back then, Armstrong and Coinbase’s third employee, Olaf Carlson-Wee (who today runs Polychain Capital, the largest U.S. crypto hedge-fund) would team up in epic Halo matches against co-founder Fred Ehrsam, a former high school gaming champ.”

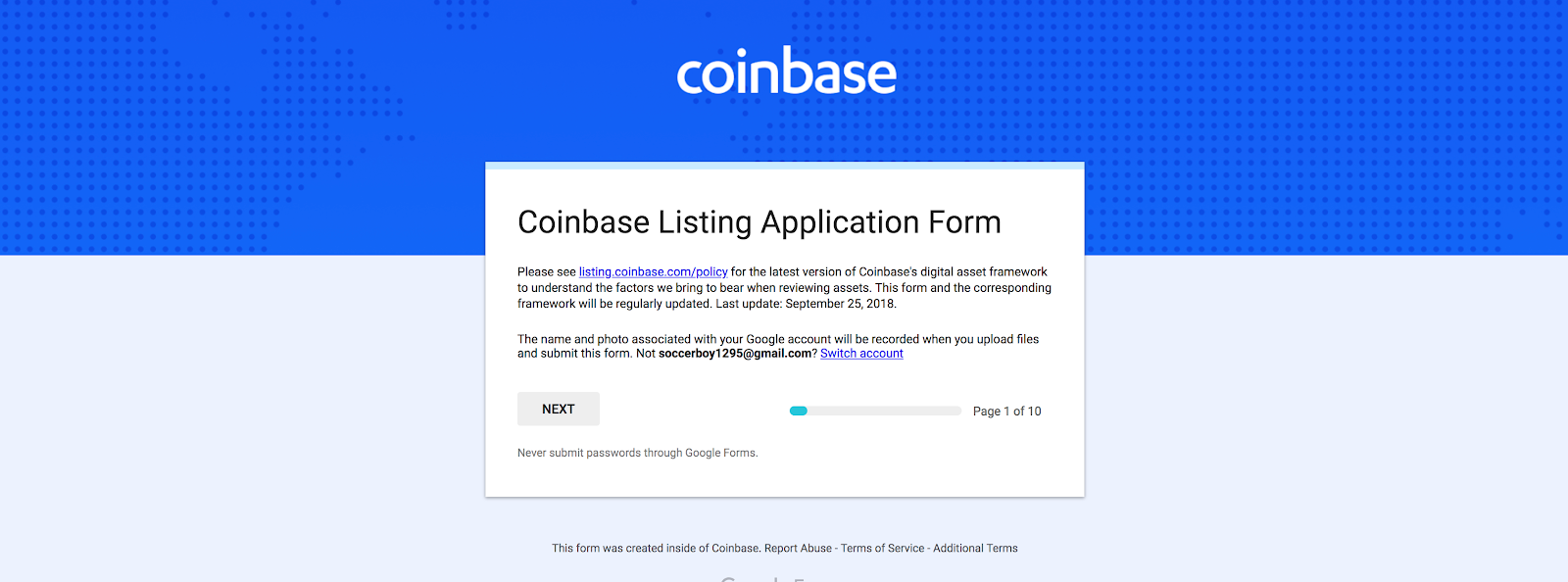

In addition to the Fortune profile, Coinbase announced Bundle, a basket of cryptocurrencies that can be bought to give exposure to users, and Listing, which allows people to submit tokens to be listed on Coinbase through a… Google Form. Okay a nice Google Form, but still a Google Form. Imagine being a multi-billion dollar company that has been insanely selective in terms of listing tokens since inception and is now taking requests for listing through a Google Form.

What is happening here? I listened to the Laura Shin podcast with CZ of Binance, and CZ mentions that Binance takes hundreds of thousands of dollars in listing fees for each token it decides to list. His argument is that listing these tokens on Binance is a huge boon to the listed token and a big value add. (Contrast that from this statement from Radar Relay: “We are not charging token issuers a fee to apply for our relayer. We are not charging six figures to buy a place on our platform. We are not taking ongoing fees.”) Listing many tokens is a natural, cash creating next step for Coinbase and maybe doing it through a Google Form is Coinbase’s way of doing it as fast as possible.

The interesting thing here is Binance is thinking of creating its own decentralized exchange, which CZ mentioned in the same podcast would be on-chain, built for speed, and have its own blockchain (he tweeted about it recently as well). Curious to see how it will play it out

Deep Dive

Q&A with James Ferguson of Gods Unchained

R: What’s the story behind Gods Unchained?

J: We think game publishers can provide more value to players than they currently do. Gamers spend billions of dollars every year on in-game purchases, yet these purchases are often little more than a license to play with a specific item or skill within the game. It’s not ownership. Players can’t trade these items, and if they can, publishers often ban real-world trade or the ability for players to sell in-game assets for real money. Game studios today are akin to a centralized bank with no regulation, and we firmly believe tokenizing in-game assets through distributed ledgers like Ethereum will benefit players. We wanted to create Gods Unchained because as TCGs have switched to a digital context, we lost the trading and collectible elements that made TCGs so unique in the early days of the genre, and here’s our opportunity to get it back.

R: Why do blockchains and video games work?

J: We think video games are the lowest hanging fruit in crypto outside of finance. Gamers are technologically-savvy and have an intuitive understanding of digital assets given the role they’ve played in video games for decades. There are also profound benefits for players when these in-game items are tokenized given the real-world trade economy it creates. There is just too much value there to ignore, and gamers are the ones that can easily navigate any frictions that come with being such early adopters.

R: How will Gods Unchained scale?

J: One of the choices we’ve made with this game is it runs all off-chain in a Unity client, only the assets themselves are on-chain. This approach ensures true item ownership for players through Ethereum, but also permits us to create more sophisticated, scalable games through the use of off-chain engines.

R: What is the 0x value add to the game?

J: We want to lay the foundation for multiple marketplaces to exist, where players can independently choose where to buy, sell, or trade. With 0x, multiple exchanges can all benefit from networked liquidity and improved price discovery while each offering unique user experiences. Additionally, 0x eliminates the need for anyone to trust centralized exchanges to secure their assets, and instead allows users to trade assets directly from their wallet.

Ecosystem

OpenRelay (Greg Lang):

Preparing release of interactive documentation for OpenRelay LitElement widget library (will announce on OpenRelay Twitter feed when live)

LedgerDex (Matt):

We are getting close to finishing up our 0x V2 migration. Stay tuned for our next release!

StarBitEx (James):

Now only charging the taker fee in order to increase liquidity

Support 13 languages including Russian, Italian, German

Support hard-wallet for users

Bamboo Relay (Josh):

No updates, team is away at a retreat in Bali

DDEX (Diane):

Added TUSD as the third base pair after WETH and DAI. Users can start trading with WETH/TUSD. We will add more trading pairs upon market demand

Improved ledger wallet usability. Users can now switch among more than 10 different Ledger addresses

Improved browser wallet usability by adding a browser wallet usage confirmation page and wallet deletion warning

Paradex (Katie):

Continuing our 0x v2 migration

ERCdEX (Lindsey):

New and improved ERC dEX trading platform! Learn more

The Ocean (Monica):

We’re exploring arbitrage opportunities across DEXs. For now, check out our Beginner’s Guide to Crypto Arbitrage

And we also put out a Beginner’s Guide to Crypto Trading Bots for those interested in automated trading

New projects and tokens! Loopring, Zilliqa, and Republic Protocol

Shark Relay (Suchit):

Shark Relay will be officially migrating to V2 in October

We are currently updating our API documentations for easier developer readability

Jobs

Head of Community, Software Engineers @ 0x

Software Engineers @ Paradex

Community Ambassador (Spanish), Copywriter, Product Designer @ Radar Relay

Events

10/4 — DeFi Summit (apply here)

10/8 — Security Token Meetup

10/5–10/7 — ETHSF (we’ll be having a V2 workshop and Will is speaking on the Open Financial System Panel)

10/12 — NonFungible Summit (featuring Tom Schmidt of 0x)

Links

EIP712 is coming: What to expect and how to use it (Koh Wei Jie):

0x’s very own Leo and Remco helped create EIP712, which is a new standard for typed message signing, letting wallets give the user more information about the order they’re signing. A great step forward on the security and usability front.

Blockchain Governance (Peter Zeitz):

Peter, who’s part of the 0x core team researching governance and is currently poring through a stack of white papers as high as my standing desk, penned this post on the initial results of his research so far. A couple points I thought were very interesting:

-A shared goal of open infrastructure is enough to keep independent teams collaborative for some time, but as the ecosystem matures collecting revenue from the end user will be a competitive process

-Sustaining cooperative innovation is a governance problem, not a technology problem

-Projects that have the potential to become monopolies should consider introducing incentives for user ownership. User-owned projects would have a mandate to act on behalf of users rather than third-party investors.

-Voting rights assigned to equity holders is advantageous for fundraising, but introduces inefficiencies when an organization becomes a monopoly.

-Crowd sales where the later investors have the same rights as earlier investors produces a highly democratic form of governance. However, this structure removes most incentives for initial investment, so that bootstrapping becomes extremely difficult.

Super excited to see what’s next.

Bitfinex Launches Decentralized Exchange EOSfinex in Beta(Coinjournal):

Bitfinex has released EOSfinex, a dEX built on EOS. This blog post from Bitfinex says the dEX will have an on-chain orderbook along with on-chain matching and settlement. The first currency pairs listed are EOS/USD, BTC/USD, and ETH/USD. Our own relayer Ethfinex also released Ethfinex Trustless.

0x AMA (Reddit):

The 0x team did an Ask Me Anything on Reddit, responding to the community’s questions and concerns. A great response came from u/polezo who highlighted some of the lesser known projects using 0x.

Powering the Decentralized Ecosystem (Wyre Talks):

Tom and Alex from the 0x core team in a great podcast.

Technological Trends, Capital, and Internet ‘Disruption’ (a16z):

Heavyweights Chris Dixon and Fred Wilson sit down in a relaxed chat that’s a must listen. Some great moments from the podcast:

-Chris describes a board game called Dot Bomb that included many of the dot com bubble failures, but realizes that many of those companies are now built and surviving (Ex. Webvan became Instacart)

-Right now we’re in a transition period where the digital world is not as “real” as the physical world but that will be changing

-Crypto is the first thing they’ve seen in a while with a fundamentally different business model, but we are waiting for our iPhone moment

Fun Stuff

Competing narratives of the WhatsApp founder Brian Acton leaving Facebook. Forbes has Acton’s side, while Facebook’s head of blockchain David Marcus had a response. Read both and make your decision, but there was a quote that didn’t sit right with me from David Marcus: “I find attacking the people and company that made you a billionaire, and went to an unprecedented extent to shield and accommodate you for years, low-class.” Now that’s just unnecessary name calling.

Everyone seems to be talking about the rise of eSports this week. Looking a bit deeper into it, I found many celebrities already owning and participating in eSports teams, like Shaq, Mark Cuban, and Steve Aoki. I think they’re onto something.

There was a great article in the New York Times called “In Praise of Mediocrity.” Read it!

Much love,

Rahul

Questions, comments, or suggestions? Message me on Twitter