Relayer Report #12 - ETHSF Recap, Interview with Veil

The latest updates from the 0x ecosystem: 10/17/18

Sign up for Relayer Report here

0x Is Hiring

We are excited to welcome our newest engineer Steve Klebanoff to the team (0x core is now at 25 people). The past few months has included a lot of hiring, and we still have some open positions — in particular we’re looking for a Head of Community and many engineers.

ETHSF Recap

For anyone in San Francisco this past week, the number of cryptocurrency related events was insane. It was a bit of an event overload, but here’s a rough recap of where 0x was for the week.

9/4 — DeFi Summit

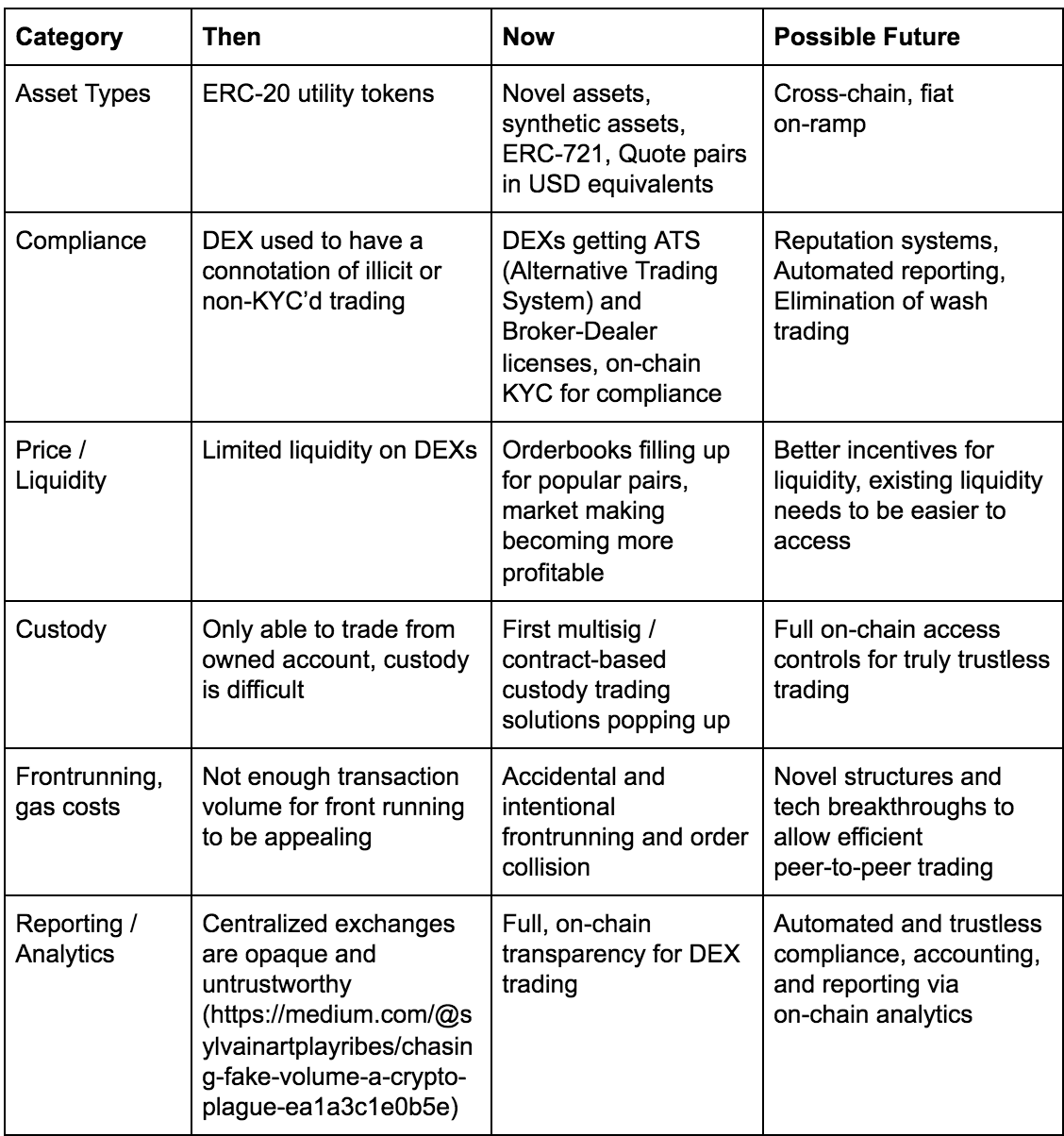

What is DeFi? DeFi stands for Decentralized Finance, and it’s a collaborative organization with many of the cryptocurrency projects who are building the new open financial system. Tom our product lead gave a talk on the past, present and future of the DEX space.

For a full summary of the DeFi Summit, look here. Peter also sat on a panel about governance.

9/5–9/7: ETHSF Hackathon

The number of talented teams hacking at ETHSF was truly amazing to see. We awarded 2500 ZRX each to two teams that blew us away: Primotif and Fungible Non Fungible Tokens. Primotif lets users buy sets of Augur and dYdX short tokens to get balanced exposure to synthetic assets like the S&P500. Synthetic assets are “a mixture of assets that, when combined, have the same effect and value as another asset” (Source). In this case, Augur tokens track the underlying asset (S&P500) while the dYdX short tokens provide a hedge on the ETH/USD price. The bundling of these assets is made possible by Set Protocol, and finally the exchange of this set for Ether is done using 0x. Are you not entertained? Tom actually wrote about synthetic stock futures in his article “18 Ideas for 0x Relayers in 2018,” so cool to see someone put it into practice — with Primotif, anyone around the world can get access and exposure to US stocks. Then there’s Fungible Non Fungible Tokens, which lets anyone co-own NFTs like shares in a company. This means shareholders can vote on how the NFT is used and modified. The FNFT wallet also lets you trade NFTs (ERC721s) and their shares (ERC20s) directly on a DEX. Super cool stuff.

At ETHSF, our engineer Francesco gave a talk about tapping into 0x’s liquidity, with slides here. The slides get into a couple of our dev tools: the Standard Relayer API, an off-chain standard that lets relayers plug into a shared liquidity pool, 0x Connect, a JavaScript client for the SRA API, and 0x.js, a JavaScript and TypeScript library that has the meat of all things needed to interface with our smart contracts easily. He also gets into our Forwarding Contract, which abstracts away some complexity from making 0x trades, as well as Asset Buyer, an easy way to instantly buy assets from our open orderbook with Ether alone.

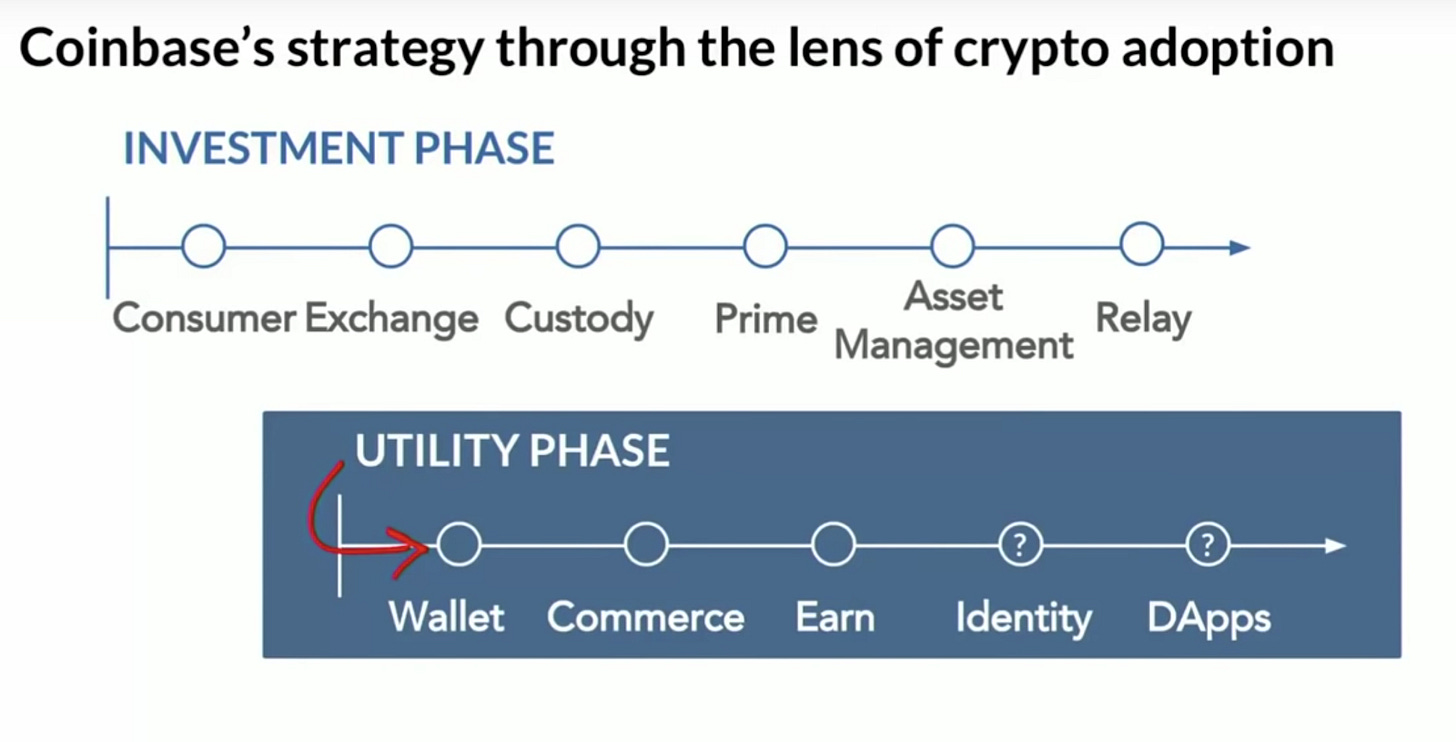

Will also sat on a panel about Building an Open Financial System with folks from Compound, Coinbase Wallet, Maker, and Dharma. The video is here (with the panel starting about 23 minutes in). Some highlights:

-This slide showing Coinbase’s ambitions from Coinbase Wallet:

-Will describes video game items as a Trojan Horse to get millions of people onboarded to cryptocurrency

-Nadav from Dharma discusses how the unbanked could make good first users for a lot of financial primitive protocols since there is less competition from traditional services (sounds like a classic Innovator’s Dilemma, where incumbents can’t or won’t tackle a subsection of possible users)

-Will says 0x’s full time job is for developers and relayers to be successful — we have customers and a responsibility to serve them. However, in contrast to normal businesses, 0x doesn’t have investors or revenue. This means that 0x is very mission driven, with a focus on doing what is best for users and developers

-Andy from Maker said he would love to see liquidity analysis from a project at ETHSF to determine what is real and fake liquidity, as well as a teardown of Coinmarketcap that subtracts cold storage hodlers to figure out the trading float in order to represent more accurate figures

10/8 — Epicenter Conference

Amir was at Epicenter on a panel about open financial systems, Will was on a panel about governance.

10/9 — New Governance Mechanisms and Cross Chain Activity Meetup

Greg gave a great talk about 0x in the context of blockchain interoperability. His talk covered how tokenization is the encapsulating of value in any form as well as the standardization of it (with standards like ERC-20). This encapsulation and standardization allows tokens to be traded freely. However, in the current blockchain landscape disjoint blockchains means value too is fragmented. Centralized exchanges form bridges between blockchains through deposit in a trusted escrow, though this comes with various drawbacks. While decentralized exchange is a better alternative, the missing piece to truly unleash DEX is blockchain interoperability.

10/11–0x Meetup

We revealed a really cool tool we’ve been building for a while! More about it next week. The Veil team also gave a presentation, but I’ll dive into Veil more below.

10/12 — NonFungible Summit

Tom presented on how the current NFT marketplace is very fragmented, and how 0x with its shared liquidity and open nature could be a good solution.

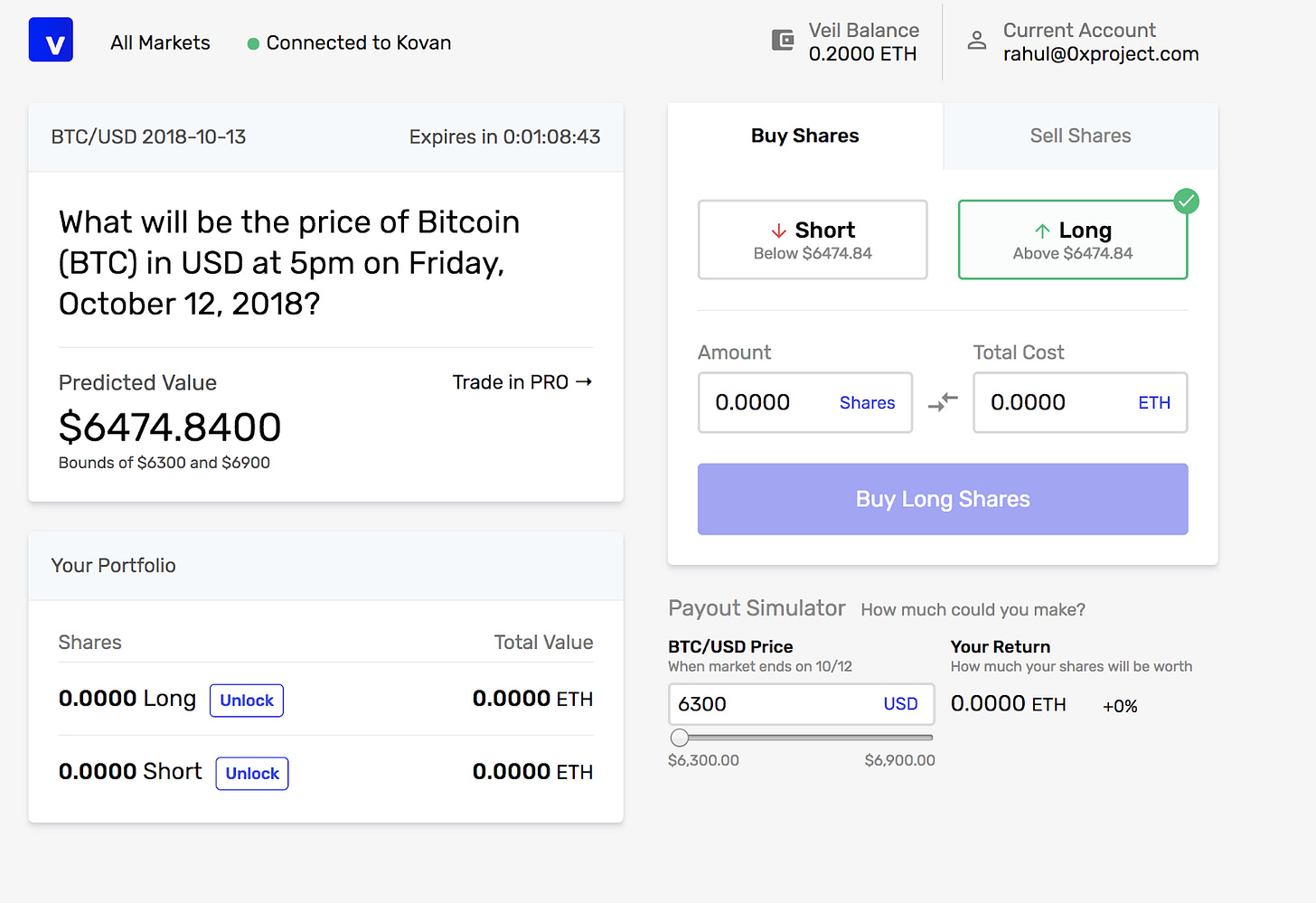

Behind The Veil

I’d like to introduce Veil to our readers — Veil is building a prediction market relayer leveraging Augur and 0x. Before reading further, check out the Veil website, Twitter, and Discord. I was messing around with the Veil alpha — here’s a look at it here.

My first question for a market like this was how the payout would change as time got closer to the date, as that would increase the chances of being right. Paul’s response: “For any contract/market that expires at X, as time approaches X, pricing of long/short shares should become more certain. For binary markets, a frenzy of trading may happen near the expiration of the market, because of the way payout works in binary markets (winner-take-all). That behavior may be less pronounced in scalar markets, where minute differences in value only have minute differences in payout.” If you want to build an Augur Relayer, check out our Rocket.Chat channel made for that purpose.

Q&A with Paul Fletcher-Hill of Veil

R: What’s the founding story of Veil?

P: Mert, Graham, and I have been working together for over 5 years, most recently via a blockchain-focused development studio we started called Hill Street Labs. We’ve been excited to see many primitives of the traditional financial system deployed to blockchains as open protocols — things like loans, exchanges, derivatives and prediction markets. But we’ve been disappointed with the lack of usage. So we decided to build Veil as a platform on top of these protocols, Augur in particular, to help many more people engage with this new financial system.

R: Why did you choose to use the 0x protocol?

P: One of the challenges of using Augur today is that every interaction is done on-chain. We wanted to make trading on Augur easier, cheaper, and faster, so we built an off-chain order book with 0x. We’ve been really impressed with 0x’s developer experience and have had a great time getting to know the team.

R: What have been your biggest technical roadmaps and challenges?

P: One notable challenge was writing order book logic for Augur markets. There are three types of Augur markets: binary (i.e. yes/no), categorical (i.e. one of many outcomes), and scalar (i.e. long/short, payout depends on where final value is between two bounds). Right now we support binary markets and scalar markets, so all markets on Veil only have two outcomes. One way of building a trading experience for these markets would be to have an order book for each outcome — buys and sells for short tokens and buys and sells for long tokens. We thought having multiple order books for each market was confusing for users, so we normalized orders and created just one order book using 0x’s matching model that shares liquidity between long and short tokens.

R: How are you thinking about making Veil easy to use and simple for new users?

P: There are so many things we want to build to make Veil (and other dapps) easier to use. First off, having an off-chain order book and paying gas for users are things we’ve already done. We also wrote our own version of Wrapped Ether called Veil Ether that is pre-approved for trading on 0x, so that makes onboarding easier for users. We’re now exploring new wallet technology, state channels, and a better mobile experience. Ideally a user who has never owned cryptocurrency could get up and running within a few minutes without having to leave Veil.

R: What are the biggest Veil use cases?

P: Right now we’ve kept Veil limited to two types of markets: Bitcoin futures and gas price futures. Both are implemented as scalar markets and expire every Friday at 5pm PT. These markets are exciting because you can gain exposure to Bitcoin on Ethereum, and the gas price product is a great hedging tool for relayers who pay gas for users. We’ve only kept Veil limited to these use cases because it’s so early, and we’re now building out support for all binary and scalar Augur markets. So anyone will be able to create a market on Augur and send others a link to that market in Veil for easy trading.

We describe Veil as “financial markets on everything, by everyone.” Ultimately, we want anyone to be able to create markets on anything, so we can’t wait to see what people do. Personally, I’m particularly excited about markets that track indices of altcoins, real-world commodities, and the popularity of posts on Reddit or Twitter as examples.

If you’re interested in getting started with Veil, we have an alpha out on Ethereum’s Kovan test network. Sign up to try it on our website: https://veil.market.

Ecosystem

Radar Relay (Beatrice):

Short tokens are coming to Radar Relay, we launched an educational site about short tokens at http://shorttokens.io

LedgerDex (Matt):

We are very excited to announce that LedgerDex has been upgraded to Version 2

We have opened up our API that follows the Standard Relayer API V2 specification

We will add more exciting new features made possible by 0x V2 to the LedgerDex web app in the coming days

StarBit (James):

Supporting 0x v2 and linked to the STAR wallet for STAR BIT EX 3.0

Changing the trading fee to Maker-Taker model

All-out effort of redesigning the UI/UX to be more user-friendly on STAR BIT EX 3.0 (will be released this month)

Bamboo Relay (Josh):

Integrated Radar Relay and LedgerDex orders

Completing Bamboo’s implementation of the SRA v2

ERC dEX (Lindsey):

Formulate or improve your cryptocurrency investing strategy by learning more about Fundamental Analysis and Technical Analysis

CEO, David Aktary, recently spoke about decentralized markets and their trajectory at Blockchain South in New Zealand

Try out the new ERC dEX trading platform if you haven’t already

OpenRelay (Greg):

Blog post Gaslighting DEXes for Fun and Profit out now

Shows how anyone with the knowhow can attribute an order to an arbitrary DEX

Continuing work to finalize the OpenRelay LitElement widget library (but getting close!)

Paradex (Katie):

Rolled out automatic API key sign-up: https://paradex.io/developers

Completed our migration to 0x v2

DDEX (Diane):

DDEX Wallet: DDEX Mobile App Public Beta Version on Apple Store and Google Play

Hydro Swap will upgrade to 0x V2, DDEX V2 upgrade following

Jobs

Community Ambassador (Spanish), Product Designer @ Radar Relay

Links

Cool project where you can tokenize your ENS domain and trade it as an NFT.

The Crypto Protocol Trying to Unite Every Exchange Order Book (Coindesk):

A profile of Paradigm, a liquidity network startup that just raised $1 million from Polychain, Dragonfly, and Chapter One. Paradigm’s CEO Liam Kovatch (who’s a sophomore at Columbia) also gave an interesting interview with the Columbia Blockchain club where he dives deeper into Paradigm.

Lessons from Coinbase’s Wild Ascent: Four Rules of Scaling (First Round):

A look into the crazy, crazy world of hypergrowth from Coinbase’s director of engineering Varun Srinivasan. An interesting concept brought up in this article is “you ship your own org chart,” where the ideas is that products resemble the structure of the teams making them. Srnivisan also brings up a funny anecdote where the goal of Coinbase’s engineering team was to increase US revenue, while the bis dev team was measuring progress by international percentage of revenue, leading to conflicts between the teams.

Binance Listing Fee Update (Binance):

Binance is making all listing fees completely transparent, and is donating 100% of fees to charity.

Fun Stuff

Photoshop is coming to the iPad — I’m super excited to see this. As the editing of photos and videos becomes more available and easier to do, at some point we won’t be able to tell what is real and what is not. At the same time the speed at which information travels is faster than ever before. I wonder what’s going to happen, but cryptography and private keys could be the solution.

Vitalik regrets adopting the term smart contracts, and wishes they were called something like “persistent scripts.”

I wrote about the Sure Fire Soul Ensemble in RR 10, and I’m excited to see them this Friday in SF. This is my favorite song of the month: “What’s New” by St. Germaine.

Much love,

Rahul

Questions, comments, or suggestions? Message me on Twitter