Relayer Report #14 — EtherDelta Ruling, Permissioned Liquidity Pools, and ERC dEX Interview

The latest updates from the 0x ecosystem: November 19th, 2018

Sign up for Relayer Report here

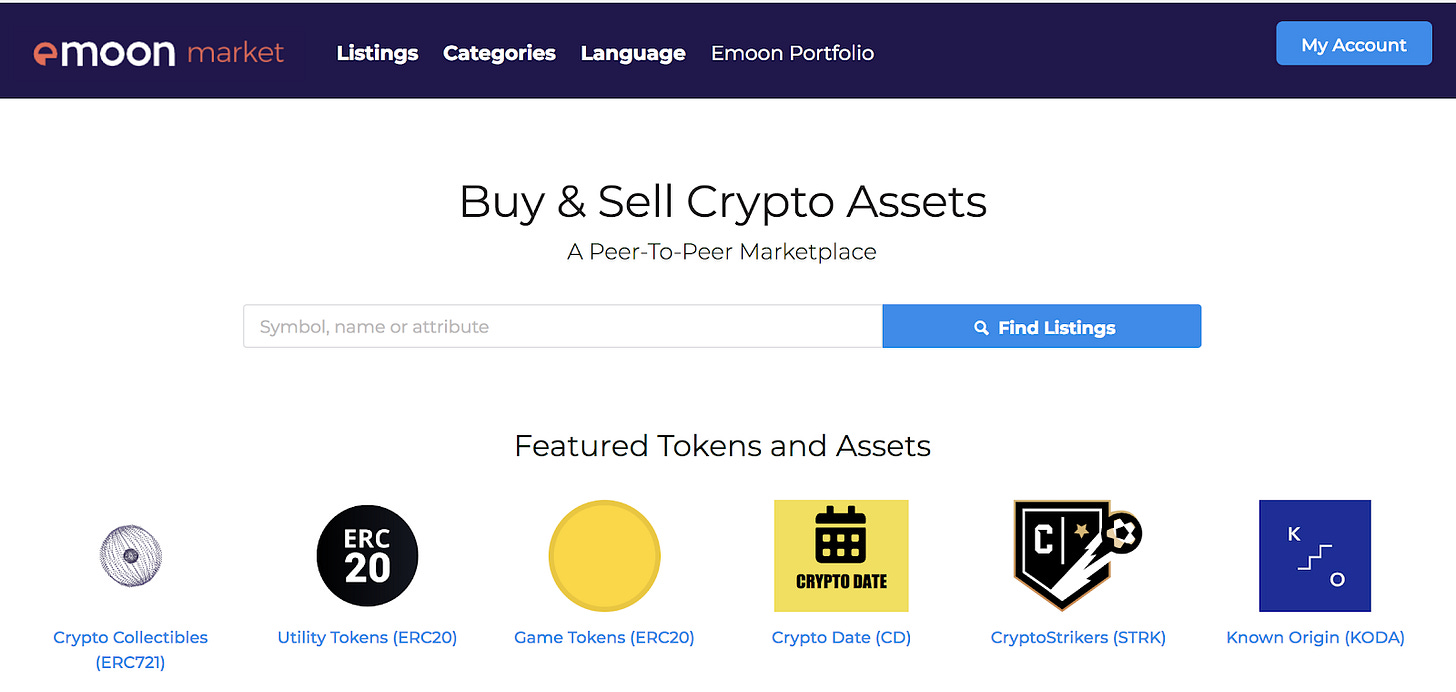

We have a few new relayers to announce — first we have Emoon, a peer-to-peer marketplace for crypto collectibles that also enables users to track and analyze the assets they’ve bought.

Hut34 is next, which is in the early stages of becoming a data marketplace relayer. The founders have worked on a variety of projects in the cryptocurrency space, including an easy-to-use cryptocurrency wallet, a stablecoin backed by the AUSD, and a version of wrapped BTC.

On the 0x side of things, we are excited to announce the 0x Launch Kit. We compare it to Wordpress, with anyone able to fork the Launch Kit and add token trading functionality to their project in a few steps.

EtherDelta Ruling

In case you missed it, the SEC charged EtherDelta creator Zach Coburn with a violation of federal securities law. Make sure to read 0x’s official statement, a regulatory update from Radar Relay, and OpenRelay’s take on the news.

The final order from the SEC is here, and worth reading.

Highlights:

-Coburn was ordered to pay $75,000 in penalty, and $313,000 in disgorgement plus interest, which brings the total to $388,000 (On a lighter note, at the end of the report the SEC details various payment options for Coburn, including paying by ACH transfer, check or mail. Obviously there’s no other way to do it, but paying SEC fines the same way you pay other things is a funny idea. Please Venmo the SEC @sec-gov)

-A lot of important dates in the report. 7/12/16: EtherDelta launches, 7/25/17: SEC releases DAO Report, 12/15/17: Coburn sells EtherDelta to foreign buyers. After the sale, EtherDelta was hacked and also announced an ICO — Spencer Noon talked about this in relation to the birth of ForkDelta a few months ago

-Lots of great links in the footnotes showing the SEC did their research, from linking to the ERC-20 spec on GitHub to Nick Szabo’s 1994 piece Smart Contracts. They also discuss maker / taker orders and even link to Coburn’s Reddit posts

There’s a lot more to be taken from this ruling, so check out this summary as well as a collection of resources below for those who want to dive deeper into the implications.

Resource List:

SEC settlement with Paragon and and Airfox, along with a follow-up announcement about all their recent activity

Great Coincenter article that gets into money transmitters vs security exchanges in the context of the ruling

Bully on Twitter — read all his recent tweets

Lawyer Priya Aiyar on why cryptocurrencies and DEXs are hard to regulate, as financial institutions target the regulation of intermediaries, something crypto wants to eliminate

Etherscan address of EtherDelta contract — currently about $11 million, likely a fraction of the total fees collected. If anyone knows how to see the total amount of fees collected for this contract, let me know

CoinDesk piece that brings up two key questions: the amount of liability a developer has for her code and whether this will push DEXs to change geographies

In-depth reading of the SEC action from DLx Law

Compliance On The Blockchain

Back in April, Will released a post about compliant peer-to-peer trading, making use of the terms “permissioned token” and “permissioned liquidity pool.” Using a permissioned token, token issuers can enforce KYC / AML checks on any token transfers:

“Permissioned tokens place restrictions on transfers directly within a token’s contract code, limiting ownership to Ethereum addresses that meet certain requirements. Aside from transfer restrictions, these tokens can behave like any other ERC20 token that one may be familiar with. The most common implementation of a permissioned token is straight forward: every time the token’s transfer function is invoked, the token contract checks a Registry contract to see if the recipient is registered to a whitelist. The transfer will only complete successfully if the recipient is registered to that whitelist.”

A key part of 0x V2 was the introduction of filter contracts, which take 0x orders and check them to make sure they satisfy a set of conditions. With filter contracts, relayers can create permissioned liquidity pools, where a collection of 0x orders are only available to a select list of Ethereum addresses, thus allowing relayers to enforce KYC / AML on trades. OpenRelay is doing some work on this front with something called Order Pools:

“The idea of order pools is that we will create partitioned groups of orders within OpenRelay that have their own constraints in terms of what orders can be uploaded to the pool, and what orders should be visible through the pool.”

What’s also been popular lately in the relayer ecosystem has been Wyre, an API and SDK for compliance. Version 1 of Wyre is built specifically for decentralized exchanges — once a customer has entered her information, Wyre will mint an ERC-721 that verifies a user’s identity on-chain. This KYC token is universally accessible, meaning that each individual relayer would not need to create their own KYC token or process. The Wyre team compares this to the blue checkmark of Twitter, allowing a user to compliantly trade on a DEX. This “minter” role will initially be played by the Wyre team, but eventually, Wyre will have an open procedure for becoming a minter.

A key benefit of permissioned liquidity pools and Wyre is that market makers who need KYC / AML in order to comply with regulations can now do so. Wyre even has an an OTC trading team that will be market making on permissioned liquidity pools across decentralized exchanges.

Interview with ERC dEX’s Lindsey Renken

I asked longtime 0x ecosystem community member and CMO of ERC dEX Lindsey Renken a few questions about the progress of the 0x ecosystem thus far and the differences between relayer and protocol.

R: What it’s been like to watch the 0x ecosystem grow and mature?

L: I cannot really comment on the ecosystem as a whole, but my experience helping to operate a relayer has been really interesting. We have been around since the beginning, since 0x launched their V1 protocol. Radar and Paradex were the first to announce their presence in the ecosystem. We were just organizing our team at launch, but we announced our closed alpha shortly thereafter. It’s been a really interesting experience.. I’ve helped to found companies in different industries, biotech, travel, but my experience in crypto, and the 0x ecosystem, has been different because there are so many similar companies growing and competing so closely in parallel after this kind of “big bang” event. This phenomenon occurs whenever there is a significant innovation or market void discovered, and there is interest from a wide audience. We’ve seen this in other industries. When this happens, you get ideas from other teams, you see how you can be better, all in real time. It’s an exciting way to build a company, but it also means that you’re always on, 24/7, because you want to outpace the competition on every little thing. All companies have competitors, but this has been next-level.

R: How has the V2 experience been?

L: It’s been exciting to see V2 come out. Having developed a V1 product, V2 kind of allowed us to answer a lot of the questions and solve a lot of problems our users had been raising. We believe we’ve been able to develop a product that is easier and even better to use.

R: How does building a relayer compare to building a protocol?

L: Relayers have a unique experience because we share a protocol. We are competing with each other, but we’re also collaborating, especially those that are sharing liquidity. Because we’re built on 0x, we all want 0x to succeed, but we are also rooting for other relayers to succeed… so I would say it might be more similar than you think at this stage. We all have a shared goal: to help this market grow and mature.

R: How do you breakdown problems between what relayers need to solve and what 0x needs to solve?

L: When you break it down at the tech level, we look at what functionally makes sense to build on a case-by-case basis. We don’t want to create smart contracts as of yet, which is one of the reasons we decided to use a protocol. As a relayer, we try to do all we can on the tech side to supplement functionality that hasn’t been built into the smart contracts. Ideally on the marketing front, we would like to work a bit more independently. Our customer base should be unique from those solely interested in 0x, but often times users find us through researching the 0x protocol. I suspect this is the case for other relayers at this stage.

R: What key decisions have you made on the UX side of things?

L: Our philosophy is to attempt to abstract all that is foreign that does not add to the trading experience. Coming from a centralized exchange, a user won’t be familiar with wrapping ETH or setting token allowances. Thus, for example, we’ve introduced a “check out” process where we educate the user just-in-time, whenever the information is relevant to helping her meet her trading goals on our platform. The process is intelligently customized to each individual users’ situation or goals. All these foreign experiences a user encounters when using any application on the blockchain creates friction, and we try to remove it without sacrificing the added benefits of the blockchain. All of our small UX decisions add up to a better overall experience.

Ecosystem

STAR BIT (James):

STAR BIT released SDK for the project that makes it easier market make

Building pool which can make the traders buy SBT directly

In progress making “MarketBuyOrdersWithEthAsyr”

DDEX(Diane):

Released DDEX Wallet 1.1 with new features of retrying or accelerating stuck transactions, Wallet Connect, and multi-base-pair,multi-language and multi-currency support

Added MetaMask’s privacy mode

Changed Market’s price and price change to CoinMarketCap’s data (refreshed every 1 min)

Radar Relay (Beatrice):

We’ve checked off our list of backend improvements and are now tackling user interface with a rebuild of our front-end. Read more about it here

We last wrote about our regulatory strategy a year ago, it’s time for an update. Read about our updated regulatory strategy here

Veil (Paul):

Added markets and data feeds that correspond with r/MemeEconomyposts (would recommend this white paper as background). Create your own meme markets by submitting a link here

Launched a system for handling fees, starting with a 1% fee on the trade amount in ETH. Fees will change over time as we issue rebates to makers

Added a portfolio page (note you have to be logged in to see the page), so users can quickly view all the markets they’ve participated in as well as their current performance in those markets

OpenRelay (Greg):

OpenRelay is taking proactive compliance measures in re: the SEC action against EtherDelta; check out the plan in our latest blog post

Coming soon: Custom Order Pools! Order pools will give builders the flexibility to set customized rules for their own pool of orders

Order pools will also help builders adapt to the shifting global regulatory landscape, enabling them to implement safeguards like KYC/AML

Lake Project (Rishabh):

Officially launched, intro post with more context, Discord and Telegram now open

AI being benchmarked with last 3 years of crypto data and traditional capital markets

Started researching decentralized investing layer, SRA-compliant API and trading API are in the process of being built

Jobs

Product Marketing Associate @ Radar Relay

Links

An Overview Of Decentralized Trading Of Digital Assets (The Brooklyn Project):

Really good general overview of the DEX space from The Brooklyn Project, an initiative from ConsenSys and Cardazo. It was a great review for me to compare and contrast the various approaches to DEX, along with smart contract code to follow along with.

Prediction Markets (Circle Research):

Great deep dive into prediction markets from Circle Research, comparing and contrasting Augur, Gnosis, and Stox along with descriptions of general challenges across the prediction markets space.

Awesome Decentralized Finance (GitHub):

Curated list of the many DeFi projects in the space.

New User Interface (Radar Relay):

After a period of user testing and experimentation, Radar Relay unveils a sleek new UI.

Fun Stuff

I’m listening to the audiobook of Shantaram right now, about a convict who escapes from jail in Australia and flees to Mumbai. It’s vivid descriptions of the city and host of morally questionable and magnetic characters makes it a great read.

“Since the most contentious (from a philosophical perspective) part of the community amputated itself into Bitcoin Cash, it should not be a surprise that they are capable of further self-mutilation.” (Source)

Much love,

Rahul

Questions, comments, or suggestions? Message me on Twitter