Relayer Report #17 - Making Money in DeFi Now, Veil and Mobidex Launch, 0x Tracker Redesign

The latest updates from the 0x ecosystem: 1/18/19

Sign up for Relayer Report here

Welcome back to the Relayer Report. I took a break for New Years and it feels like I haven’t done this in a while. I guess I’m getting nostalgic now that we’re in 2019, but I still remember the first Relayer Report I wrote back in May from my college dorm room… Time flies. I got into the habit in that room of working from my bed, something that I still do now, is that bad for my back? Asking for some wisdom from the crowd.

0x ended 2018 with a bit of a bang, with the public unveiling of the ecosystem acceleration plan, a website redesign, the CoinList hackathon announcement, and the Coinbase Earn announcement. Since the new year started, we’ve had some big updates as well.

First, we added longtime community ambassador Brent Oshiro to the team. Brent’s been helping out the 0x team purely out of passion for a while now, so it’s exciting to have him join the team full time. Welcome Brent!

Next, we announced our Market Maker program, which will be providing onboarding, support, and monetary incentives for market making on 0x. Bringing liquidity onto our DEXs is a huge huge priority, and we’re doing everything we can to make it happen.

On the dev side. Leo published this piece about the release of a couple of our internal ethereum dev tools for the public. With the Unix philosophy of “each tool should only do one thing, and one thing well,” the tools can make compiling your Solidity easier, give you stack-trace like error messages, measure code coverage, and save you gas. They’re general purpose and built for the broader Ethereum community as a whole, and come with sexy documentation.

Steve published our monthly dev update, which has a lot of cool features we’ve been messing around with and adding to the protocol. We’ve been working on a Python SRA client, a robust data pipeline, and some extensions to our current contracts, like a Dutch Auction extension and testnet implementations of our Multi Asset Proxy.

Finally, Will published a post about the 0x Roadmap, detailing our three priorities for the year (data, liquidity, and DeFi), as well as the processes around our ZEIPs (0x Improvement Proposals). The ZEIPs are our chance to test and experiment with governance processes, and the first few ZEIPs cover the Multi-Asset Proxy, ERC-1155, and the TEC (trade execution coordinator).

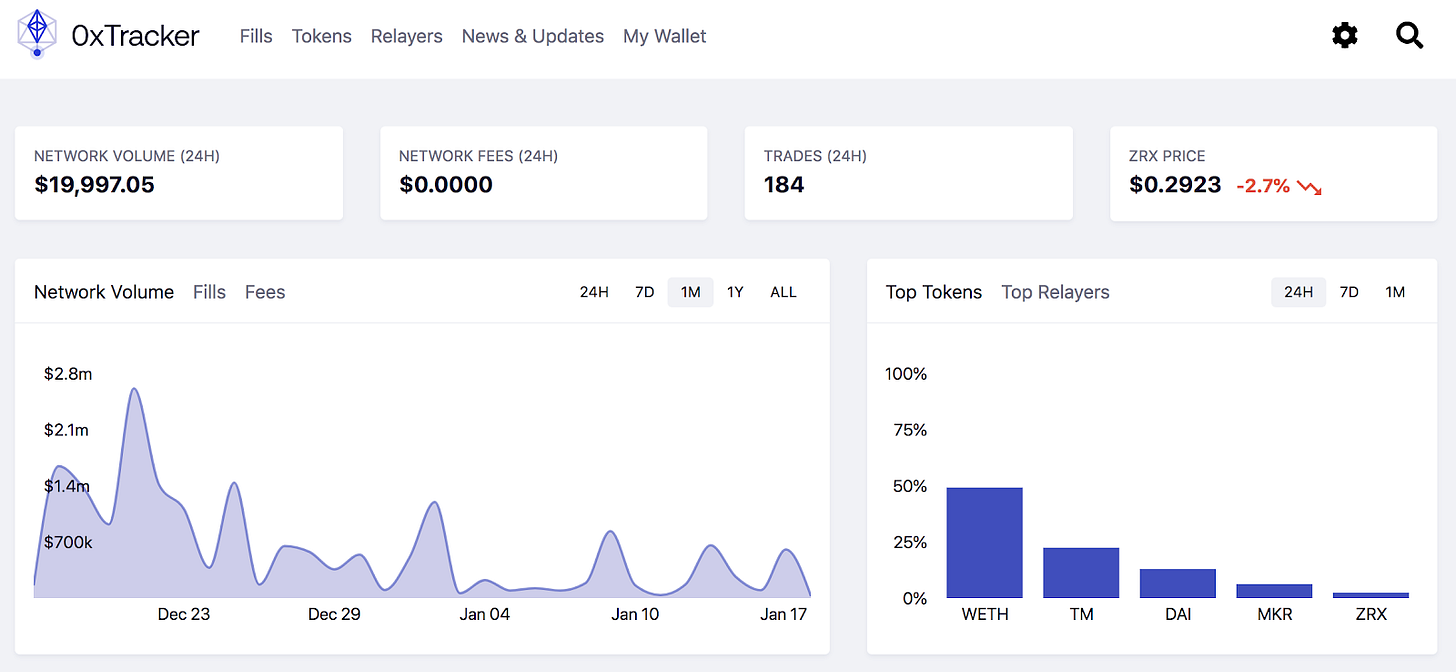

0x Tracker Redesign

0x Tracker is a great tool from the community and recently got a fresh new look. Check it out and play around — it has a great snapshot of what’s going on in the ecosystem at the moment. Follow 0xTracker on Twitter to stay up to date.

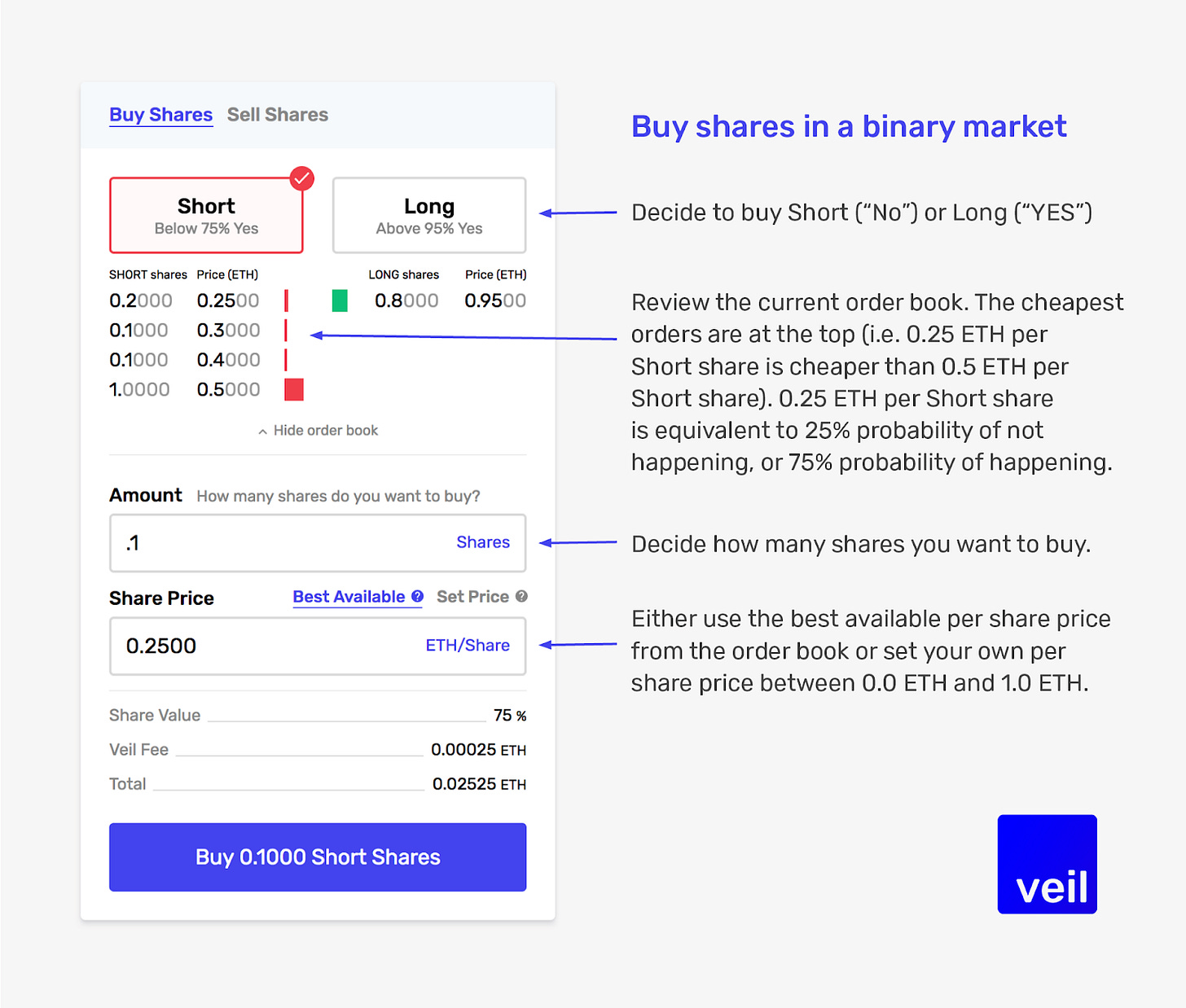

Veil and Mobidex Launch

Veil, the love child of 0x and Augur, just launched on mainnet this week, in addition to announcing a seed round from Paradigm, Sequoia, and 1Confirmation. I interviewed Veil in RR#12, and they described the advantages of using 0x’s off chain orderbook model to make Augur faster and cheaper to use. Additionally, Veil has the power to instantly settle their markets, as opposed to the multi-week settlement process of Augur, meaning users can get their winnings faster. The Veil team published educational content around the company here.

Unfortunately, Veil is closed to to users in the US and a few other countries. Nick Tomaino from 1Confirmation details the difficulties of complying with regulations for companies like Veil:

“The regulatory landscape for Augur is unclear, especially in the United States. Entrepreneurs in the U.S. must consider the CFTC when it comes to derivatives regulation for binary markets, state regulators when it comes to gambling, as well as FINCEN and CFPB when it comes to money transmission. Until more clarity is given by regulators on how they view Augur and Augur-based services, it is important to tread carefully based on your role in the ecosystem and jurisdiction.”

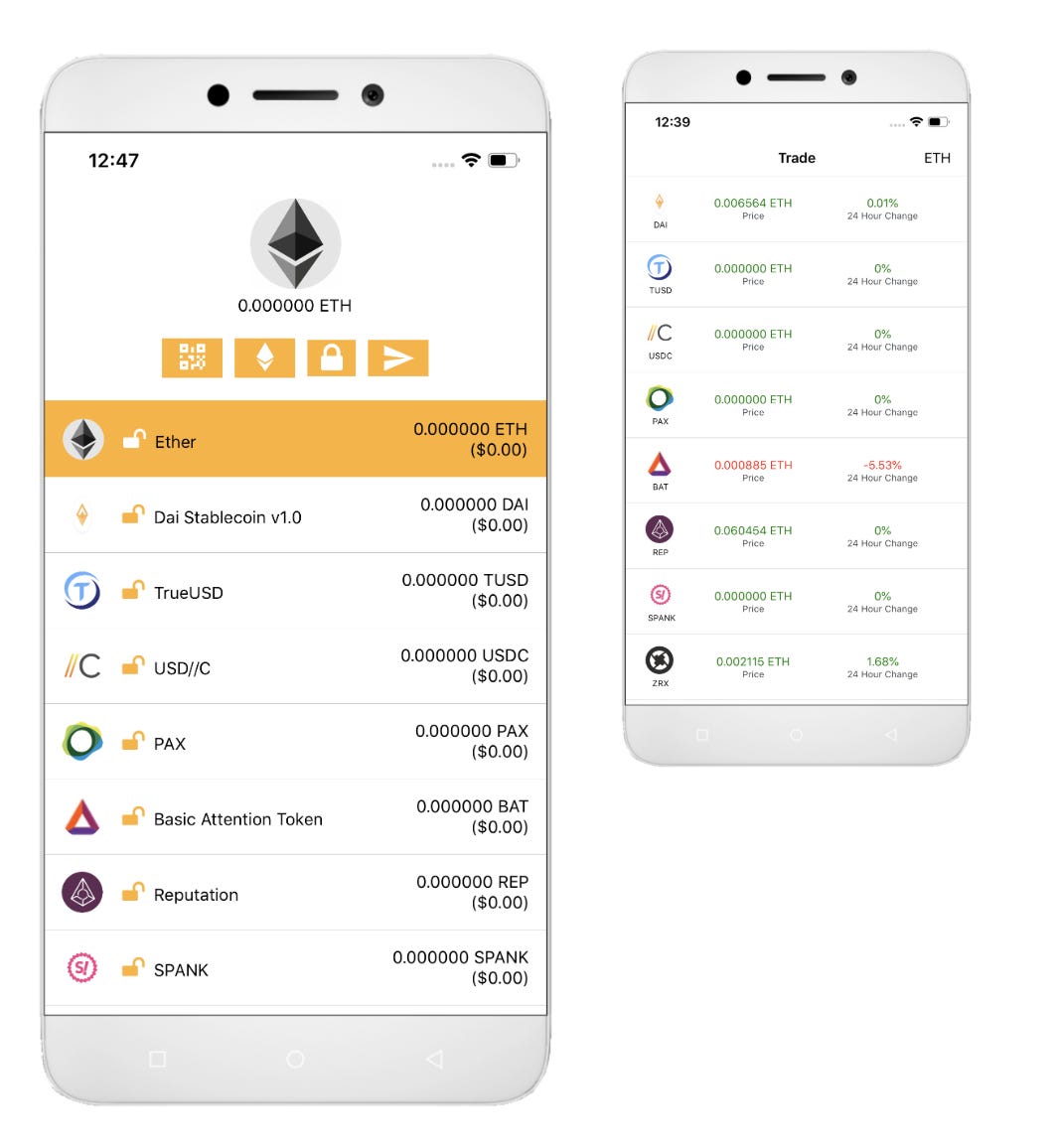

In addition to Veil, 0x mobile first relayer Mobidex also launched this week. Download Mobidex on the Google store or App Store.

0x Team Spotlight: Greg Hysen (Blockchain Engineer, Office Canadian)

Q: What’s your role at 0x and what have you been working on lately?

I’m a Blockchain Protocol Engineer. As an engineer on the protocol team I focus primarily on smart contract R&D, which involves a variety of interesting research areas: interoperability, token mechanics, and generally how to make our protocol more accessible, flexible and extensible. The role more or less continuously evolves along with the industry, which keeps you wired in.

Q: How did you get into crypto? What were you doing before 0x?

I started doing web dev back in high school and kept running into questions that forced me to gradually work my way down the stack. I built a website and wondered: how does the browser work?; then it was, How does the server work?; and then How does the operating system work? Eventually I’d worked my way down to designing processors in Verilog, and that’s when I was finally ready to stop. You couldn’t trust me with a logic board and a soldering gun.

I eventually found my passion in operating systems. I co-authored a microkernel for autonomous navigation and spent a few years contributing to a distributed 3D mapping platform for drones.

I first learned about Bitcoin in a cryptography course at the University of Waterloo, but my interest really peaked after I discovered Ethereum. It was a new kind of OS with a ton of fascinating problems yet to be solved.

Q: What’s the weirdest / most interesting thing you’ve found when working with smart contracts?

You’re only ever one bad instruction away from losing everyones money and that keeps you on your toes.

Q: As a Canadian, what do you think of America?

There is but a fine line between us.

Ecosystem

BoxSwap (Charles):

BoxSwap is an over-the-counter relayer made for swapping ERC-20 and ERC-721 assets in a network of marketplace communities.

Went from supporting Cryptokitties -> supporting Cryptokitties, MLBCryptoBaseball, Decentraland Estates, Axie Infinity

Introduced a beta program where we guide users through a swap and give away crypto-collectibles

Bit2Me (Ivan):

Getting its start in 2014 by connecting Bitcoin with thousands of ATMs in Spain, Madrid based Bit2Me is a matching relayer for ERC-20 tokens.

Multi-language support in: Spanish, English, Portuguese, Italian and Romanian. More languages in the future

Native Ledger support in web implementation and future implementation for mobile.

Fiat support through Tikebit (Service to buy ETH in physical stores)

STAR BIT (James):

STAR BIT is a matching order book relayer based in Taiwan.

Optimize URL transaction order

Developing a new Dapp game for the Traditional Chinese festival

Redesigned a new homepage for the demand of business collaboration

Emoon (Jim):

Emoon is a peer-to-peer marketplace for the exchange of ERC-20 and ERC-721 crypto assets.

Listed 8 new ERC20 assets

New ERC721 assets in the works with deep metadata support

Working to enable relayer API with ERC721and ERC20 assets

Radar Relay (Whitney):

Radar Relay is an open order book relayer made by an international team based in Colorado.

Added Spanish and French to the user interface

Added an indicator line for limit orders to show where on the spread they will be placed

Added USDC and GUSD stable coins as trading pairs with WETH

Added a manual refresh to the portfolio drawer, along with minor bug fixes

Lake Project (Rishabh):

Lake Project is a Canadian relayer building user-friendly trading and investing tools for the decentralized financial future.

Figuring out a way to integrate multiple exchanges (centralized or not) to power algorithmic trading

Benchmarked AI across multiple time periods and weighting

Open Relay (Greg):

Open Relay is an open order book relayer with a focus on scalable and open source backend infrastructure.

New blog post re: vetting tokens for SEC compliance

OpenRelay awarded a 0x Ecosystem Acceleration Program grant (big thanks to the 0x team and community!!!)

Announcing OpenRelay Pools, a way for builders to define custom views of our order book

Mobidex (Abe):

Mobidex is a mobile first wallet and open orderbook relayer.

PAX and USDC tokens are now listed in Mobidex

Apple finally approved Mobidex for distribution in the App store

Mobidex is soft launching Thursday, January 17th, 2019 and will be available in the App and play stores

Veil (Paul):

Veil is a non-custodial trading platform for blockchain-based derivatives and prediction markets.

Launched Veil on Mainnet. Read the launch announcement and our blog post sharing our seed round from Paradigm, Sequoia, and 1confirmation.

Added support for categorical markets. See the live Academy Awards Best Picture market as example.

Try DeFi

As part of 0x’s focus to grow the DeFi pie, I’m adding a section in the Relayer Report to focus on up and coming DeFi projects. For this week, here’s a guest post from my friend Matteo, now a research analyst at The Block, on money making opportunities in DeFi.

How to Make Money in DeFi Now (Matteo Leibowitz):

Decentralized Finance (DeFi), Open Finance (OpFi) — call it what you will, the emergence of permissionless, intersectional financial primitives is the most exciting trend in the blockchain ecosystem right now, quietly threatening to chip away at Wall Street’s rent-seeking hegemony and promising — albeit ambitiously — to provide cheap access to financial services for the world’s 1.7 billion unbanked population.

While widespread, global adoption of these protocols is still some years away, and there remains plenty of work to do on the user experience front, enterprising and adventurous users have the opportunity to explore and leverage their utility today.

Additionally, because the markets created hosted by these applications are still in nascent phases, there are multiple inefficiencies to be exploited, and, consequently, real, hard ether to be made for those willing to go that extra mile.

Of course, before you go out and start playing with house money, it is worth noting that this is still highly experimental software, subject to vulnerabilities that may well cause you to accidentally depart with your funds.

Lending:

Compound is an Ethereum-based permissionless money market, a sleek platform for users to supply and borrow crypto assets on a variable yield basis. Borrow and Supply rates change over time based on supply and demand — if supply is high relative to demand, borrowing rates will be cheap, and vice versa.

If you plan to own ZRX over an extended period of time, you might wish to generate intermediate returns by lending it at an Annual Percentage Return (APR) of 0.10% — i.e. lending $100 worth of ZRX over a year will net you a return of $0.10. If you see a short opportunity, you can borrow at 5.85% APR.

Things get particularly interesting when you look at Compound’s DAI market, where Supply APR currently stands at 4.18%, having declined from 15.33% in December.

Considering anyone can seamlessly generate DAI by locking up Ether in a Maker Collateralized Debt Product (CDP) for an annual 0.5% fee, there is an attractive arbitrage opportunity to be executed by drawing DAI and supplying it at 4.18% for a 3.68% return. To reduce risk in your arbitrage strategy, you can open a short position to hedge against your CDP’s ETH exposure by borrowing the same amount of ETH you post as collateral, selling it immediately, and then returning it when you close out your CDP.

It’s also worth monitoring price discrepancies between Compound and alternative lending platforms, such as Dharma relayer, Bloqboard, which also offers markets across BAT, DAI, WETH, ZRX, and REP. While spreads are currently tight, we might expect to see some divergence in the future as users spread interest unevenly across the two exchanges.

As highlighted by Tony Waldschmidt, Compound’s margin maintenance mechanism, which allows any third party to purchase the collateral of an over-exposed contracts at a 5% discount, also presents a relatively low-risk and lucrative strategy to sophisticated users.

Like Compound, Maker employs a discounted liquidation feature — currently at 13% — in order to ensure that all contracts remain sufficiently over-collateralized. Monitoring and ‘biting’ overly exposed CDPs, or participating in the recently-launched secondary market for CDPs, can generate risk-free reward (if you can outpace the bots and/or frontrunners).

If you’re feeling particularly optimistic about the price of ether, you can also use Maker to lever up by 3x.

Market Making:

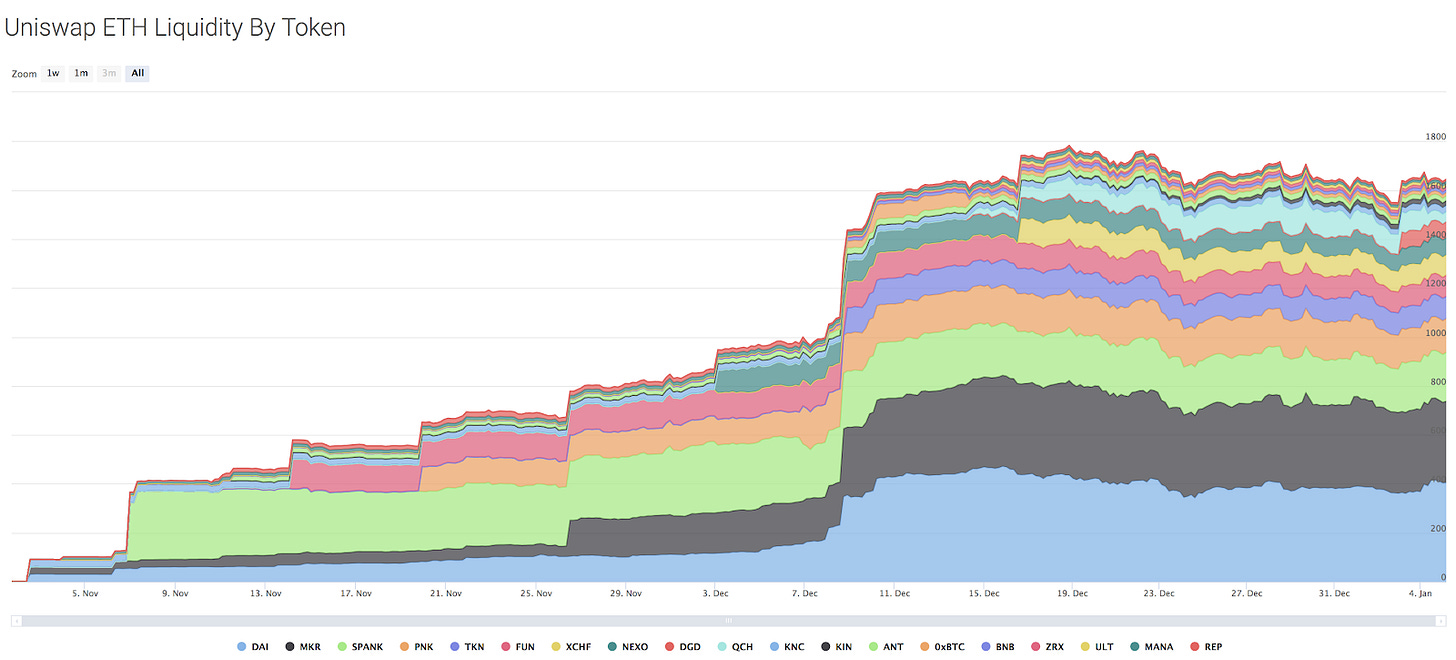

In addition to 0x’s Market Maker Program, Uniswap also employs an incentive scheme for liquidity providers, with a 0.3% fee on every trade split proportionally among participants, although analysis indicates that price volatility can cut into returns.

As more decentralized exchange protocols move to mainnet — Uniswap, DutchX etc. — and flash lending applications build traction, it’s also worth keeping an eye on lucrative cross-protocol arbitrage opportunities.

Predicting:

Permissionless prediction market Augur also presents multiple opportunities to generate income, ranging from: the creation of markets, which nets a ‘market creation’ fee; participating in the oracle dispute system, which nets an ‘oracle bond’ if the market resolves in your favour, and by arbitraging rates across Augur-based markets and centralized competitors like PredictIt.

In addition, with some risk appetite and a healthy dose of conviction, you can scoop up shares in contentious unresolved markets, such as ‘Which party will control the House after 2018 U.S. Midterm Election?’, which has ‘Democrats’ shares trading at a 3.5% discount due to debate over the semantics of the word ‘after’. Or, more simply, do your homework, build some information asymmetry, and buy/sell shares in one of many markets on offer.

Links

DeFi Games (NFTY News):

Big fan of NFTY News, and their thoughts on combining DeFi with games is really interesting. A game of Temple Run that ends with you creating a Maker CDP? Wild.

Abacus Raises 2 Million (TechCrunch):

YC startup Abacus raised 2 million, with a goal to “automate compliance for tokenized security transactions and keep track of the chain of custody of private securities.”

A Data-Driven Look Into Dapp Adoption (Dune Analytics):

A somewhat sobering deep dive into the numbers that matter for various protocols. Bloqboard also had a good data driven report on the decentralized lending protocols.

Integrating With 0x (Pixura):

The Pixura team talks about how they built their digital art marketplace using 0x. For more on art and blockchain, Forbes published an article on the topic.

Wyre Integration for 0x Exchanges (Kirk Ballou):

A step by step article covering how to implement KYC for relayers.

Fun Stuff

A cryptocurrency guy in Hong Kong dressed like Robin Hood going to Berghain made banknotes fall from the sky.

Dr. Elon and Mr. Musk — a Wired profile on Tesla and the gigafactory from hell.

Everything you need to know about Ethereum’s Constantinople.

The ugliest coin in the world commemorating 70 years of currywurst.

I’m a big Kobe fan and he just spoke at the Tron conference, I am not not jealous of Justin Sun.

An old article heard through Farnham Street, “Why Time Management Is Ruining Our Lives”.

Much love,

Rahul

Questions, comments, or suggestions? Message me on Twitter