Relayer Report #18 — CDP 101, MyCrypto Acquires Ambo, DappBoi, The Donut Wars

The latest updates from the 0x ecosystem: 2/5/18

Sign up for Relayer Report here

For this week’s Relayer Report, I put some time and effort into the new Try DeFi section, explaining how to open a Maker CDP (big thanks to Matteo and Max for helping me write that). I would really appreciate some feedback / Twitter roasting.

Will was at AraCon on January 30th, and he gave a presentation titled “Using Metamodels for Cross-blockchain Governance.” The 0x + Coinlist Hackathon ends February 7th and we had some great workshops from Veil, Wyre, and Radar, among others. Our January Dev Update included a variety of interesting stuff: smart contract tools for the broader ecosystem, more Python packages, and a lot of research (TEC, Selective Delay, Continuous Time Matching, TEC Compatibility with Forwarding Contract).

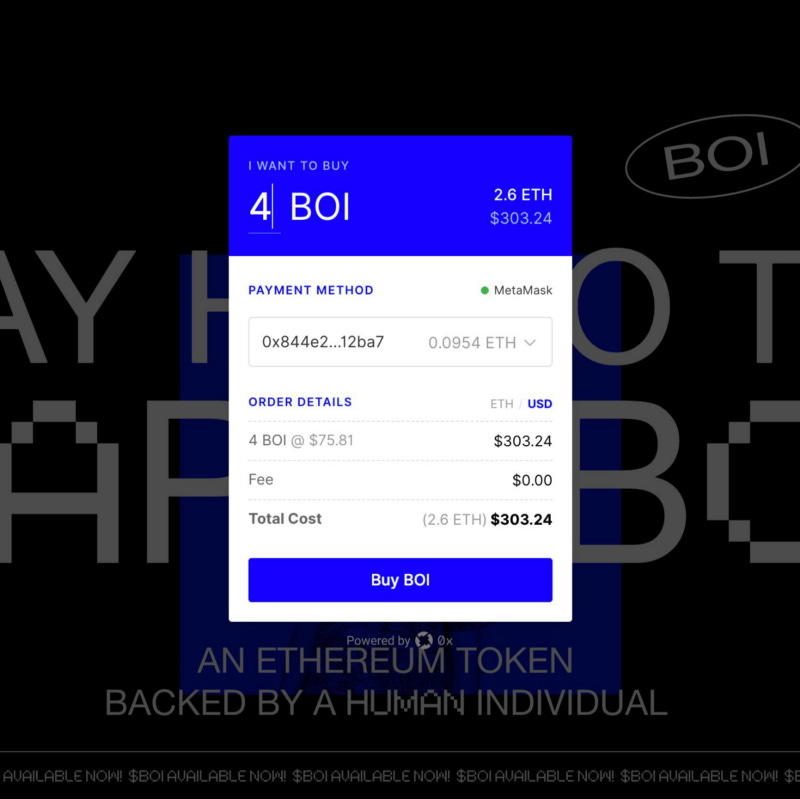

DappBoi Radio

The coolest Instant Integration might have to go to designer Matthew Vernon, affectionately called Dapp Boi. Dapp Boi is selling the BOI token, which is redeemable for Matthew’s design and dev work. Before you say this is indentured servitude, Dapp Boi has a list of reasonable terms: he will not mow your lawn, he will not work on illegal projects, and he has the right to refuse anyone. The project was inspired by Dapp Boi’s reading into Personal Tokens, allowing people to profit share in individuals just like they do in companies.

One Donut To Rule Them All

Will had a tweetstorm on the whole donut debacle, but here’s the short story — on a popular cryptocurrency subreddit called r/ethtrader, karma (or the internal credit system, think likes, favorites, or upvotes) is represented in credits called donuts. There are two million donuts minted each week, and they’re awarded to users for upvoted content. Donuts are powerful signaling for people in the ethtrader subreddit — the more donuts someone has, the greater their reputation. Donuts can also be used to set the banner image on the subreddit.

A community member created donut.dance, a website that converted donuts into tradeable ERC-20 tokens. Users traded donuts on BoxSwap and Uniswap, enabling Will to quickly become a Donut whale….

And upload a custom 0x banner to the subreddit:

As a result of the tokenization of Donuts, the price of Donuts exploded. Last I checked, the subreddit was discussing how to decentralize the Donuts process. Super cool stuff.

MyCrypto Acquires Ambo

Ambo is a 0x relayer and mobile wallet led by a three person team out of LA, and they were recently acquired by MyCrypto. I sat down with Jai Bhavani, CEO of Ambo to dive deeper.

Q: How will Ambo fit into the MyCrypto vision? How will your role change?

At MyCrypto, Ambo will continue to work on developing the Ambo Wallet and build it out for all three major platforms (Web / iOS / Android). That being said, over the past month our goal has evolved into ‘making web3 accessible.’ With some upcoming projects, we hope to turn the investment motive surrounding trading beyond just pure “speculation,” and encourage the “utilization” of the these tokens that people are pouring money into.

Q: How did you hear about 0x? What made you interested in the ecosystem?

We started building Ambo on a centralized exchange and that required our users to input API keys which was an absolute user experience nightmare. After seeing Tom’s post, “18 ideas for 0x Relayers in 2018,” we realized we were building on almost half of his ideas and instantly we knew that we wanted to build on 0x. I emailed Tom and received a response within a day and we had implemented 0x within the next 2 weeks.

The updates to 0x are what have kept us here. Our team initially had issues with autonomous wrapping and token allowances and despite us fixing them, the 0x team created the ‘Forwarding Contract’ which ensured that no developer would suffer the same issues.

Q: A good user experience seems to be one of the core selling points of Ambo — how has Ambo made UX a priority? What are other crypto teams doing wrong when it comes to UX?

Our superb user experience is one of our proudest accomplishments. We leverage anonymized data on how our beta testers use the app in order to inform every decision that we make. We tried to make the broadest beta group possible (people in crypto, traditional investors, students) in order to ensure our app can capture all of these different users on launch.

Additionally, we find many other wallet products in the ecosystem fundamentally flawed. These wallet products rely on dApp browsers. Those browsers serve the dApp developer’s experience which inevitably clashes with the experience created by the wallet. At Ambo, we believe that protocols like Augur should be focused on producing the protocol and instead allowing people like Ambo, Veil, and Guesser to build on top of it rather than building their own interface. This will allow for protocols to build the best protocols possible, and products to build the best experience.

ForDex: A Stablecoin Relayer

The team over at Zenprivex has been hard at work building a stablecoin focused relayer called ForDex. ForDex will have a range of centralized and decentralized stablecoins in one place, from USDC to DAI to non-USD stablecoins like KRWb, the Korean Won. Additionally, ForDex will have a fiat on ramp for their services made in collaboration with Wyre, as well as key plugins to traditional forex markets.

While it is currently in alpha mode, if interested in partnering with ForDex contact partnership@fordex.co, and if you want to keep up with their latest updates, follow ForDex on Reddit, Twitter, Medium and Telegram.

Ecosystem

Bamboo Relay (Josh):

Bamboo Relay is an open order book relayer for ERC-20 tokens.

Token approvals and wrapping ethereum are now streamlined by batching these actions before placing or filling orders

SRA websockets now emit changes for orders that have their statuses changed, i.e. filled, removed, canceled

We have started improving UX for mobile wallets and small screens

Radar Relay (Whitney):

Radar Relay is an open order book relayer made by an international team based in Colorado.

Announced Radar as the parent brand that maintains Radar Relay

Click to copy amount for market orders — in testing

Added WBTC trading pairs

Minor layout updates and scroll bars — in testing

Backend, 0x libraries updated in preparation for TEC

Emoon (Jim):

Emoon is a peer-to-peer marketplace for the exchange of ERC-20 and ERC-721 crypto assets.

The four top ERC721 crypto assets available (CryptoKitties, God’s Unchained cards, Decentraland parcels, Etheremon monsters) for trading on the site

Asset explorer is complete: https://www.emoon.io/assetExplorer

English auction bidding platform released, enabling users to auction off assets, accepting bids for either ERC20 tokens or ERC721 assets (functionally a swap)

STAR BIT (James):

STAR BIT is a matching order book relayer based in Taiwan.

STAR BIT made a SLOT game for Chinese new year events and this time we support both ETH and SBT

Will support WBTC in near future

Developing a few Dapps for an upcoming event

Ambo (Jai):

Ambo is a mobile-focused wallet and relayer acquired by MyCrypto.

We have been acquired by the team at MyCrypto!

We are putting the finishing touches on our mobile app before it goes in for a security audit

Lake Project (Rishabh):

Lake Project is a Canadian relayer building user-friendly trading and investing tools for the decentralized financial future.

Revamping authentication and wallet service to support multiple wallets in the near future

Getting ready to add in DAI support

Productizing AI to be used within the 0x ecosystem in the near future

OpenRelay (Greg):

Open Relay is an open order book relayer with a focus on scalable and open source backend infrastructure.

New blog post about the origins of the SEC and how that relates to the present day

OpenRelay team will be hacking at ETHDenver (look us up if you’re there!)

Introducing OpenRelay Lens, blockchain analytics powered by OpenRelay

Bit2Me (Ivan):

Getting its start in 2014 by connecting Bitcoin with thousands of ATMs in Spain, Madrid based Bit2Me is a matching relayer for ERC-20 tokens.

Full responsive support with app-like interface in the browser

Running full tests both in the back and the frontend to ensure support on launch day

Ending the final retouch of the interface

BoxSwap (Charles):

BoxSwap is an over-the-counter relayer made for swapping ERC-20 and ERC-721 assets in a network of marketplace communities.

Introducing a wallet for NFT traders

Try DeFi: Opening A CDP

The MakerDAO CDP sounds like a CIA covert operation that just became public, but I’m here to break it down for you.

The Basics

MakerDAO is the organization behind Dai, a stablecoin that is pegged to the US Dollar. 1 Dai will (hopefully) always be worth 1 USD, but MakerDAO accomplished this without any centralized entity nonsense (like Tether, USDC, TrueUSD etc.) or shutting down (Basis)

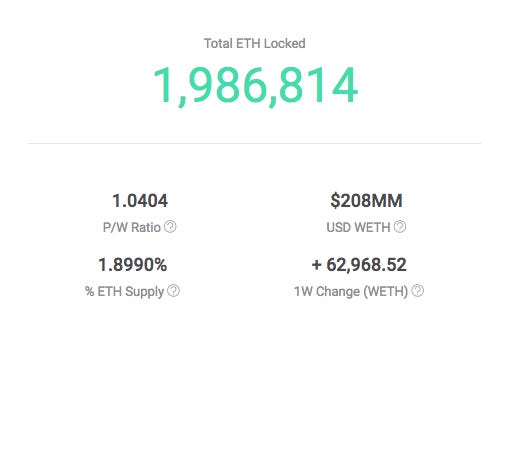

A CDP stands for Collateralized Debt Position. In essence, you take out a loan with Ethereum as collateral (though in the future Maker is exploring more collateral options). Nearly 2% of all Ethereum in supply is locked up in CDPs, completely dwarfing all other protocols. Very impressive (Maker has a bunch of cool data visualizations at mkr.tools)

Maker has made opening a CDP as easy as possible — with the use of proxy contracts, locking collateral and generating DAI all happens in a single atomic transaction, without the tedious approving of allowances or wrapping of Ether. There’s a reason so many people are opening CDPs — it’s easy to do!

Collateralization Ratio

There’s a few numbers and ratios to keep in mind when creating a CDP. The first is the collateralization ratio, which is the value of your locked up collateral divided by the value of the amount of DAI you take out as a loan. The minimum collateralization ratio now is 150% percent, so if the collateralization ratio dips below 150%, your CDP is liquidated. In the liquidation process, a CDP is locked, the collateral is auctioned off to cover the CDP’s debt, and the remaining collateral is returned to the user (minus the liquidation penalty, which is described below. For a full in depth on liquidation, MakerDao had a good Reddit post).

Let’s say you have 1 ETH, valued at $150. To find the maximum number of DAI you can create, you solve for x: 1.5 (the collateralization ratio at 150%) = 150 (the value of collateral) / x (number of Dai). Here, x is equal to 100 Dai. The caveat is, however, that since your CDP is liquidated any time the collateralization ratio goes below 150%, if you take out a 100 DAI loan with ETH valued at $150, ETH dropping 1 dollar would liquidate your CDP (149/100 = 1.49, which is less than 1.5). As a result, it is best to overcollateralize your loan with a ratio above 150% (Maker recommends a ratio of 200% and above). At a 200% collateralization ratio, you would only be able to mint 75 DAI, but you would lower the risk of your CDP getting liquidated.

The global CDP collateralization is 282%.

Stability Fee and Liquidation Penalty

The other numbers to keep track of are the stability fee and liquidation penalty. Right now, Maker charges 0.5% APR per year in a kind of tax for keeping the whole system stable, and the revenue from this tax goes to MKR holders (eventually part of this tax will go to the Dai Savings Rate). The MakerDAO community recently voted on decreasing the stability fee from 2.5% to 0.5%, which was approved, with the latest governance call suggesting the stability fee will go up to 1.5% soon. Much like how the US government plays with interest rates to affect the economy, the reduction in the stability fee incentivizes the minting of more DAI. At the same time, the stability fee is paid in MKR (MakerDAO’s other token, used for governance) and then burned, so decreasing the stability fee increases the amount of MKR in the world, which (in theory) should decrease the price of MKR. Thus far, 530.64 MKR has been burned to date, visualized by Maker here.

The liquidation penalty for a CDP is the amount that will be subtracted when a CDP is liquidated — the current liquidation penalty is set at 13%. When compare to Compound’s liquidation ratio of 5%, for example, this liquidation penalty seems to be pretty high — the reasoning behind this is to incentivize CDP owners to maintain margin and keep the system stable, with any 3rd party able to liquidate a CDP a profit.

What’s the point?

It’s easy to see why a stablecoin like DAI is valuable to the Ethereum ecosystem — volatility in cryptocurrencies is very real, and for a decentralized finance system, a stable medium of exchange is absolutely necessary. What in the world, though, is the point of creating a CDP? Since CDPs are overcollateralized in nature, why not just sell the ETH you have for DAI?

1. Go long on crypto

The biggest use case for a CDP is leverage — taking the DAI that you mint and going out and buying more crypto. A great example of this is the Looping CDP launched by InstaDapp (the people behind MakerScan, a data analytics page for all things MakerDAO). Looping CDP lets you take out a 3x recursive leverage long on ETH, meaning in one click, the following happens:

a. You take out a CDP using ETH as collateral and receive Dai

b. You trade the DAI for ETH

c. You use the new ETH to create another CDP and receive Dai

d. You trade the new Dai for ETH

e. You create another CDP with your new ETH

If the price of Ethereum goes up, you profit. If it goes down, let’s not talk about that.

2. Take loans from yourself

Let’s say you have a $5,000 student loan at a 5% interest rate over the next 4 years. Instead of sticking to the terms of the loan, you could take out a $10,000 loan from a CDP, pay off your current loan in cash, and your new interest rate is 0.5% as opposed to 5%. You could even sell Dai for cash and put it into an index fund that returns 7% annually, meaning you are being charged 0.5% for 7% returns. The caveat, however, is that this only makes sense if you are set on maintaining your long exposure to ETH over this time period. If ETH falls more than 5%, this does not make as much sense. (Capital gains also need to be factored in to this simplified model. Thanks to this Reddit comment as well for the ideas around this).

3. Profit from demand for Dai

At various points, the price of DAI has exceeded $1 when the demand for DAI has been greater than the supply. In this case, a user can create a CDP, mint Dai, and sell it for greater than $1, meaning immediate profits. At the same time, when the demand for Dai is less than the supply, people with open CDPs are incentivized to buy back Dai at sub $1 prices and pay back their debt on the cheap. This ebb and flow keeps the price of Dai at $1. (Great post from James Seibel that digs into this a bit).

Aftercare

To avoid the dreaded liquidation of your CDP, it’s important to take care of it. Overcollateralization is a great first step to give you some breathing room, but especially if the price of ETH is going down, stay vigilant. In addition to the Maker CDP portal, check out this Telegram bot that sends you updates on your CDP.

Further reading

Chris Burniske and Alex Evans on MakerDAO adoption

Cyrus Younessi on the relationship between DAI, MKR, and ETH

Rune’s original post on r/ethereum 3 years ago

CDP tutorial from Crypto Bobby

Links

The thin crusty of liquidity: why crypto needs more market makers (Hummingbot):

A great post from Hummingbot, a market making as a service company, on the current fragmented liquidity landscape in crypto.

0x and English Auctions on Emoon (Emoon):

NFT relayer Emoon has implemented English Auctions for ERC-721 assets. An English auction is when bidders can see each others bids, prompting a bidding war.

Welcoming Predictions.Global to Veil (Veil):

Veil acquired Predictions.Global, a popular website for browsing Augur markets. Founder Ryan Berckmans will be joining Veil in an advisory capacity.

Dharma Labs Raises 7 Million (CoinDesk):

Dharma closed out their Series A with $7 million in funding from Green Visor Capital, Polychain, and Coinbase Ventures among others.

A Wallet For NFT Traders (BoxSwap):

NFT relayer BoxSwap with a portfolio like website to manage your NFT assets.

Fun Stuff

Spanish people complain that their new devil statue looks too nice.

zkERC20: the confidential token standard.

Accidentally Turing complete — not all things were meant to be Turing complete.

“Bitcoin investors may be out $190 million after the only guy with the password dies, firm says”

Much love,

Rahul

Questions, comments, or suggestions? Message me on Twitter

Learn more about 0x and join our community

Website | Blog | Twitter | Discord Chat | Facebook | Reddit | LinkedIn | Subscribe to our newsletter for updates in the 0x ecosystem