Revamped Documentation, Asset Swapper, and Ethfinex becomes DeversiFi

0x Ecosystem Update — August 2019

Hello 0x community! Our ecosystem had a busy month. In this report, we’ll review a few new releases from the 0x Core Team, aggregated data from the 0x Network, and important updates from ecosystem projects. Let’s dive in!

General 0x Updates

The New and Improved 0x Docs

We completely revamped 0x Documentation to simplify building on 0x. Our goal with this redesign was to provide more structure and significantly improve the developer experience across three main areas:

Getting up-to-speed on what you can do with 0x

Finding the right place to get started

Accessing the content you’re looking for

We added a ton of helpful resources including core concept guides, tutorials, an on-chain API explorer, and even search! Take a look and get started building at 0x.org/docs.

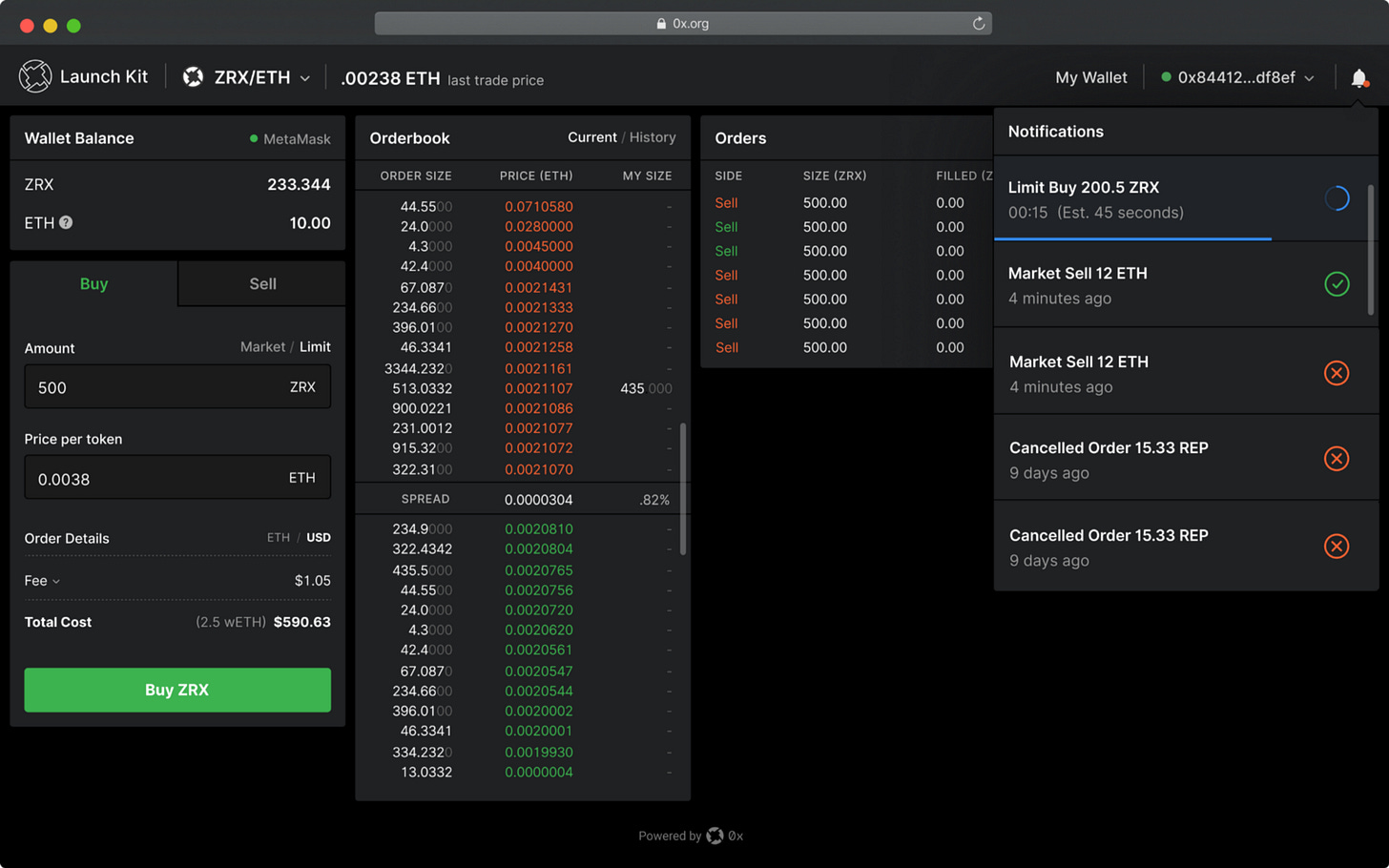

Contract-fillable Liquidity Made Simple with Asset Swapper

After working with 0x integrators like dYdX, we discovered that it was too complex sourcing liquidity from 0x via existing smart contract architectures. In response, we released Asset Swapper, a powerful tool that enables DeFi projects to automatically find liquidity, pass it into their smart contracts, and fill orders at the best prices from 0x’s networked liquidity pool.

Asset Swapper is a convenience package that provides a simple way for smart contracts to leverage contract-fillable liquidity and exchange Ethereum-based assets. DeFi developers can flexibly use Asset Swapper to swap tokens in a single line of code or build custom integrations for more advanced token trades. Get started here!

ZRX Staking Parameters

With the 0x v3.0 vote coming up in October, our Protocol Engineering team has been heads down fine-tuning the ZRX staking parameters and contracts. Check out the details here.

As a refresher, a few months ago we introduced a proposal to upgrade ZRX token economics. The idea is that a protocol fee from each 0x trade will be passed onto to market makers in the form of liquidity rewards for providing trade volume and staking ZRX over specific periods of times (called epochs). Market makers who do not have a sufficient amount of ZRX can form staking pools.

Any ZRX holder will be able to delegate their tokens to market maker pools to receive an allocation of these liquidity rewards. As more liquidity and volume flows into the 0x Network, the fees and rewards will grow proportionally. This, in turn, will incentivize ecosystem participants to hold ZRX for staking and voting on changes to the protocol that affect their usage of the network.

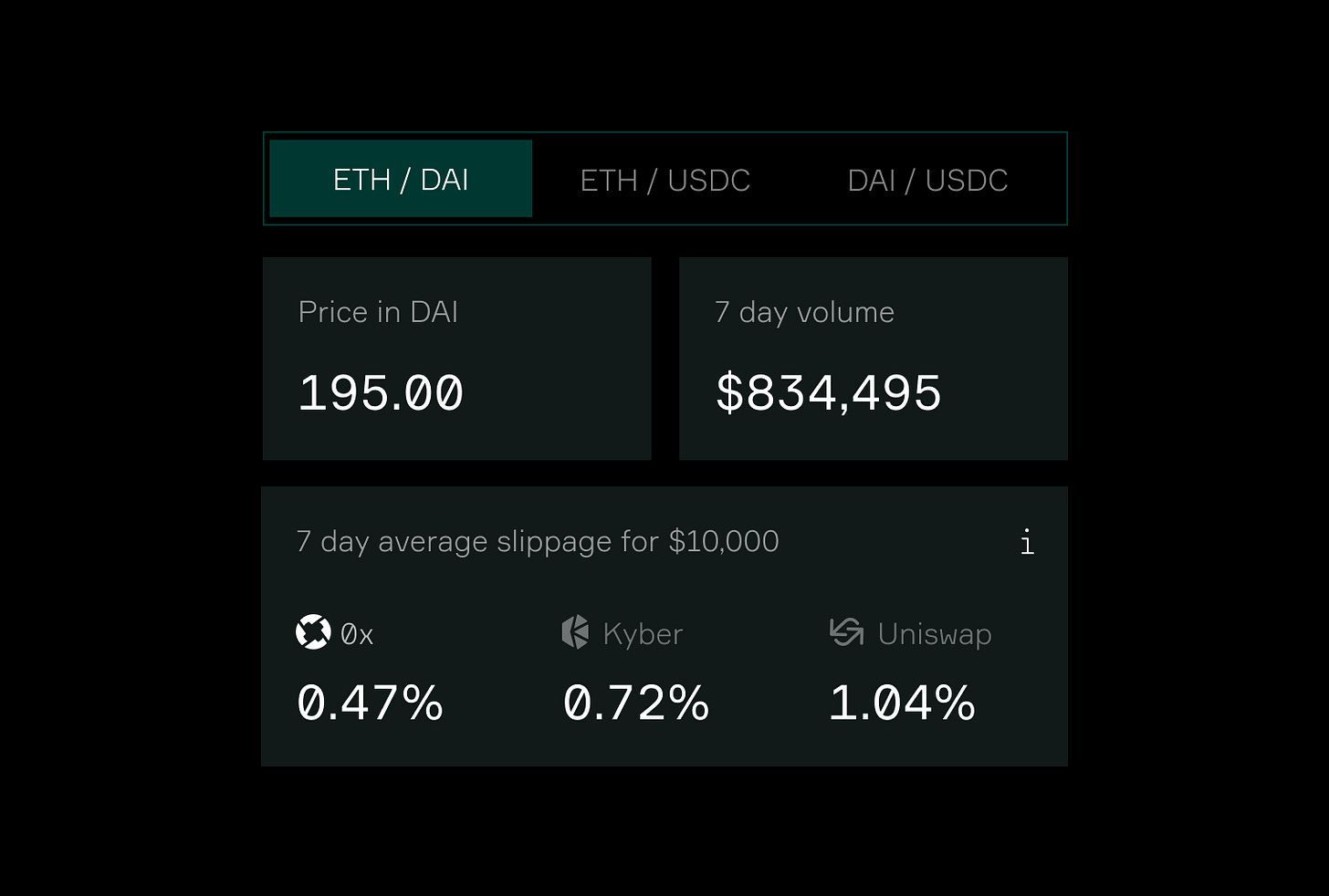

0x Network Data

0x Network trade volume was relatively flat month-over-month (MoM), however Tokenlon (imToken’s in-app DEX) had a 38% increase from July. The growth can be attributed to a spike in USDT trading. In fact, USDT was the 2nd most exchanged token behind ETH in the month of August. Let’s take a closer look at the data.

Trade volume: $30,369,681.92 (-2% MoM)

Trade count: 40,255 (+65% MoM)

Fill volume: $30,768,837 (+0% MoM)

Fill count: 41,488 (+70% MoM)

Unique makers: 1,198

Unique takers: 701

Unique addresses: 1,680

Top Tokens

We calculated volume using both canonical and Ethfinex wrapper tokens. Note that volume exceeds total fill volume due to the two-sided nature of trades.

ETH: $25,119,144 (+1.6% MoM)

USDT: $12,777,023 (+16% MoM)

DAI: $11,781,147 (-19% MoM)

USDC: $6,439,097 (-3% MoM)

Top Relayers

Tokenlon: $13,795,533 (+38% MoM)

Radar Relay: $13,481,734.7 (-20% MoM)

Ethfinex: $2,443,462.79 (-26% MoM)

Paradex: $294,519.35 (-45% MoM)

Tokenmon: $96,780.47 (-54% MoM)

Ecosystem Highlights

We are excited to support 0x relayer Ethfinex as it evolves into DeversiFi! They parted ways with their parent company, Bitfinex, to focus on building out the DeFi ecosystem. They have already implemented a new set of features for decentralized lending and margin trading utilizing bZx.

Our friends at OpenRelay released a beta of Rivet, an open-source node management service. OpenRelay developed this solution as part of our Ecosystem Acceleration Program.

The 0x team is excited to sponsor and participate in this week’s DeFi Summit in London! Fabio Berger will be giving a presentation on 0x Mesh and Peter Zeitz will be speaking on adding a selective delay to decentralized exchange. If you’re in town, we are also co-hosting meetup with Set, UMA, and DeversiFi on September 10. RSVP before its too late here!

The GU Decks team released Tokentrove.io, a slick new NFT marketplace that utilizes 0x Instant and Mesh! They currently added exchange support for Gods Unchained cards, Cheeze Wizards, and plan to add other ERC-721 or ERC-1155 tokens. It’s great to see teams utilizing the new ERC-1155 AssetProxy!

Project Updates

Chris from Tokenlon (imToken)

Tokenlon is a mobile DEX embedded in imToken, a popular crypto wallet.

About $14M in trading volume, or 71196 ETH

$1.4M peak in daily volume

20k transactions, by 10k addresses

Users mainly trade ETH <> stablecoins and exchange ETH for ATOM or EOS.

Check our tweets for weekly data updates

Ben from DeversiFi (formerly Ethfinex)

DeversiFi is a relayer based out of the UK.

Ethfinex announced their evolution to DeversiFi — the only high-speed DEX where traders can execute orders of any size directly from the security of their private wallet. The news came with the introduction of decentralized Margin and Lending features (using bZx), enhancing the competitiveness of the exchange and allowing them to close down Ethfinex.com and focus solely on building out the DeFi ecosystem.

Integrated Squarelink, offering more wallet flexibility and convenience with a user-friendly and super convenient one-for-all platform.

Attended Berlin Blockchain Week, hosting The Governance Games, and joined forces with 0x to host the #DeFi Assemble — an evening event after the popular DeFi Summit London.

Greg from OpenRelay

Open Relay is an open-source relayer and infrastructure company.

Sponsored ETHBoston

Awarded 100,000,000 RPC requests to ETHBoston winner VendEth

Rivet websockets support imminent

Antonio from dYdX

dYdX is both a margin lending protocol and a user-facing decentralized exchange that creates leveraged short and long positions on Ethereum-based assets.

Working on adding limit orders. Stay tuned for a launch announcement soon!

Added Coinbase WalletLink

Our first dYdX meetup is this Thursday September 12th in San Francisco. Please join us if you’re in the area!

Hiring Software Engineers & Product Designers full-time in SF!

Ryan from Fabrx

Fabrx is an infrastructure company that enables businesses to quickly spin up a 0x relayer.

Second version of the Fabrx IFTTT is live — set trading triggers on price changes.

WeiDEX has integrated Fabrx Trading Notifications for trading triggers and alerts. See this tweet to see how it works.

Fabrx to launch a full-fledged 0x DEX for the EncrypGen ecosystem.

Joshua from Bamboo Relay

Bamboo is an exchange that allows users to trade, lend, or borrow any ERC-20 token trustlessly.

Continued development on website re-design

Jim from Emoon

Emoon is a p2p marketplace for ERC-20 and ERC-721 (NFT) assets.

David from GU Decks

GU Decks is a secondary marketplace for Gods Unchained NFT card packs.

TokenTrove has launched v. 1.0 of its NFT marketplace. Gods Unchained NFTs and CheezeWizards are the initial tokens you can trade on it.

Andrei from Flowerpatch

Flowerpatch is an NFT-based game that utilizes 0x exchange functionality.

This was a big month for Flowerpatch, in which we have released our Alpha game world.

This is a multiplayer game board, where players may plant their FLOWERs, and breed them with other players. In the next patch, we will release a system where players earn ETH when others breed with them

Matt from LedgerDEX

LedgerDEX is an ERC-20 token relayer.

Updated order status checking method in response to the recent change in 0x.js.

Attended Blockchain Week and the ETHBerlin Hackathon in Berlin.

Crypto News

Insightful post from James O’Beirne on Bitcoin as a hedge against impending financial and political turmoil.

MakerDAO’s proposal to decentralize oracle infrastructure. 0x is proud to support this initiative!

Binance to launch crypto lending, margin trading, a new stablecoin, and Binance US.

Joel Monegro on Ethereum and the Seven Dwarfs.